- 20 min read

Brand24 vs Mention A UK Social Listening Showdown

Deciding between Brand24 and Mention really comes down to what you need your listening tool to do, and where your business is focused. For most UK businesses, Brand24 often hits the sweet spot with its knack for highly accurate sentiment analysis and strong local source coverage, all at a cost-effective price point. On the other hand, Mention is built for the big leagues—global enterprises that need massive data reach and features designed for large, sprawling teams.

This makes Brand24 the more pragmatic choice for targeted UK reputation management, whereas Mention is geared towards organisations with a much broader, international scope.

Choosing Your Ideal Social Listening Tool

In a market as competitive as the UK, knowing what your customers and competitors are saying online is no longer just a nice-to-have; it's a necessity. Social listening has evolved from simply tracking your brand name into a cornerstone of market research, lead generation, and customer service.

Tools like Brand24 and Mention have become leaders in this space, each offering a powerful way to tap into these crucial conversations. But they aren't carbon copies of one another. Their core approaches to gathering data, running analysis, and structuring their pricing cater to very different types of businesses. To make the right call, you have to look beyond the feature lists and figure out which platform truly aligns with your strategic goals.

This guide will break down Brand24 vs Mention in detail, helping you determine which tool is the right fit for your organisation's size, budget, and objectives. And for those who find neither is a perfect match, it's always worth exploring a capable Brand24 alternative to ensure you land on the best solution.

The core decision isn't about which tool is universally "better," but which one offers the right balance of data depth, analytical precision, and cost-efficiency for your unique business context.

To kick things off, here’s a quick look at how these platforms stack up at a high level. This sets the stage for our deeper dive into the specifics.

Brand24 vs Mention At a Glance

The table below offers a high-level summary, comparing the core strengths and ideal users for each tool. It’s a great starting point for understanding where each platform shines.

| Feature | Brand24 | Mention |

|---|---|---|

| Ideal User | UK SMEs & agencies needing deep sentiment analysis. | Global enterprises & teams needing vast data coverage. |

| Core Strength | High-accuracy sentiment analysis (95%) & intuitive UI. | Extensive data sources (1 billion+) & team collaboration. |

| Pricing Model | Accessible entry-level plans for smaller teams. | Scalable pricing with a focus on enterprise needs. |

| Data Focus | Strong coverage of UK-relevant forums, blogs, and news. | Comprehensive global monitoring across multiple languages. |

While this gives you a snapshot, the devil is in the details. Your specific needs for data sources, update speed, and analytical depth will ultimately steer you toward the right tool.

Comparing Monitoring Capabilities And Data Coverage

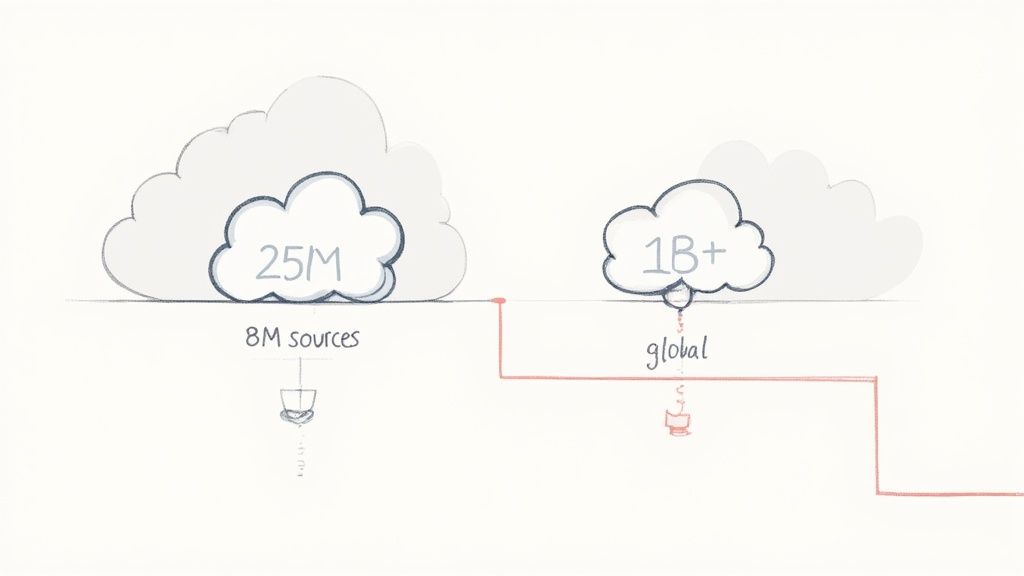

The image above gets right to the heart of the difference between these two platforms. It’s not just about how many mentions they find, but how they find them.

The core of any social listening tool is its ability to track down relevant conversations. But when you put Brand24 and Mention side-by-side, you see two completely different philosophies at play. It’s less about which one has "more" sources and more about which one has the right sources for you.

Mention casts a massive net, scanning over 1 billion sources every single day. This is a global dragnet designed to catch almost everything, making it a go-to for international brands tracking their reputation across countless countries and languages.

But if you’re a UK-based business, that sheer volume can be a double-edged sword. Digging through a global data firehose to find what’s relevant locally can sometimes feel like hunting for a needle in a haystack. It demands some serious filtering to cut through the noise.

Data Depth For The UK Market

Brand24 takes a more curated route, monitoring a focused list of over 25 million sources. While that number looks smaller on paper, its real strength is in its targeted coverage. It includes a solid collection of UK-specific forums, blogs, and news sites—the kind of places where local brand reputation is made or broken.

This focus is a huge advantage for UK businesses. When you need to know what’s being said on a local news site or a popular British forum, Brand24 is far more likely to have it covered with precision.

For UK-based companies, Brand24's curated data often delivers higher relevance per mention, while Mention's vast pool provides unparalleled global scale. The choice depends on whether your priority is local precision or worldwide reach.

It's also worth noting Brand24's strong footing in the UK. Market research shows 7% of its customer base is here, with internet and software companies using its AI to get a precise read on emotion across its source network. This is a sharp contrast to Mention’s global-first approach, which can sometimes dilute its relevance for the UK market.

Update Frequency And Crisis Management

How fast you get your mentions is crucial, especially when you’re dealing with a PR crisis or a fast-moving campaign. Here again, the platforms show their different priorities.

Brand24 pushes real-time updates on its higher-tier plans, a feature built for immediate action. For social media managers or PR teams needing to jump on negative feedback instantly, this is a non-negotiable.

Mention delivers a continuous stream of data, but the update speed can vary. It’s consistently fast, but it’s not always marketed as the "instant alert" system that Brand24 champions on its top plans. The difference is subtle but vital for teams built around rapid response.

Access To Historical Data

Your need for historical data will be a major deciding factor. This is key for analysing long-term trends, benchmarking campaigns, and understanding how your brand’s perception has evolved over time.

Brand24's Approach: The platform usually gives you access to the last 30 days of data when you set up a project. This keeps the focus on recent conversations, perfect for agile campaigns and short-term analysis.

Mention's Approach: Mention offers a much deeper archive, with some plans providing up to 24 months of historical data. This makes it the clear winner for deep-dive research, historical competitor analysis, or tracking brand health over several years.

Of course, data coverage is only half the battle. How that data is processed and analysed is just as important, especially with the rise of advanced AI monitoring tools. Ultimately, your choice between Brand24 and Mention should come down to your strategic needs—whether that’s immediate, localised monitoring or extensive, long-term global research.

Evaluating AI Features For Sentiment And Relevance

While finding mentions is the first step, the real magic happens when a tool can tell you what those mentions actually mean. This is where the AI-driven features in Brand24 and Mention really start to diverge. It’s the difference between just collecting data and getting genuine insights that can shape your brand strategy.

It's not enough to know someone mentioned your brand. You need to understand the feeling behind their words, the context of the conversation, and its real-world impact. Both platforms use AI to cut through the noise, but their approaches to sentiment and relevance are worlds apart, directly affecting how useful their data is.

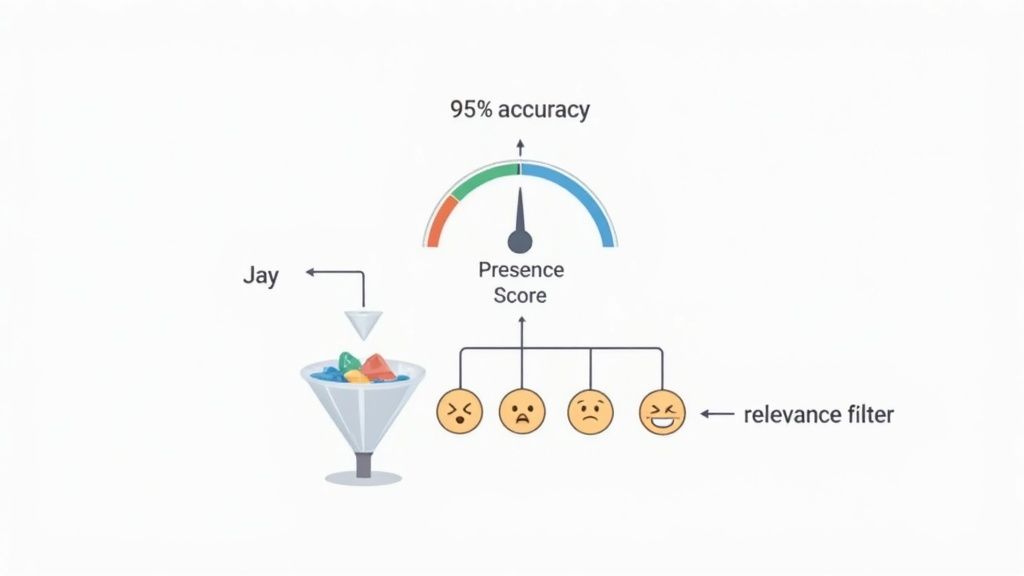

Brand24’s Precision In Sentiment And Emotion

Brand24 has staked its reputation on the accuracy of its sentiment analysis. The platform claims a 95% accuracy rate, which is a huge confidence booster. We’re not just talking about a simple positive, negative, or neutral tag here; Brand24’s AI is trained to pick up on specific emotions like joy, anger, or surprise.

This level of emotional detail is incredibly powerful. Imagine a UK e-commerce brand launching a new product. They can see beyond a simple "positive" spike and realise the dominant feeling is "joy," which tells them their marketing message landed perfectly. On the flip side, a sudden jump in "anger" can instantly flag a product flaw or a major customer service issue, letting them get ahead of the problem. If you're keen to learn more, it’s worth taking a moment to explore the best sentiment analysis tools currently on the market.

Brand24’s proprietary Presence Score is a major differentiator. It boils down several complex metrics into one simple 0-100 score, giving you an at-a-glance benchmark of your brand's online authority against the competition.

Brand24 has a solid footprint in the UK, with 7% of its customer base located here. That translates to hundreds of UK businesses using its AI to monitor 25 million sources for reputation management. It’s a popular choice for UK marketing and advertising agencies (19% of its global users) and small businesses. In fact, 42% of its customers are small firms with under 50 employees, including many UK-based e-commerce outfits who rely on its 95% accurate sentiment analysis.

Mention's Approach To AI Filtering and Relevance

Mention also has sophisticated AI, but it's solving a different problem: making sense of the colossal amount of data it pulls from over a billion sources. As a result, its AI is heavily geared towards filtering out noise and making that data manageable.

Its sentiment analysis is solid, with a reported 82% accuracy rate, but it sticks to the basics: positive, negative, or neutral. This is fine for spotting high-level trends but doesn't offer the emotional depth that Brand24 delivers.

Where Mention’s AI really comes into its own is summarising huge volumes of conversations. Its AI-powered digests can quickly pinpoint key topics and trends bubbling up from thousands of mentions, which is a lifesaver for large companies tracking global campaigns. The intelligence is built for macro-level understanding, not the micro-level emotional analysis that Brand24 hangs its hat on. For a closer look at how these systems operate, check out our guide on https://forumscout.app/blog/ai-social-listening-tools.

Ultimately, your choice comes down to what you need most. If your focus is on proactive reputation management and truly understanding customer emotions, Brand24’s precision gives it the edge. But if you're dealing with massive datasets and need to see the big picture, Mention’s AI is built to handle that scale.

Analysing Pricing Models And Value For Money

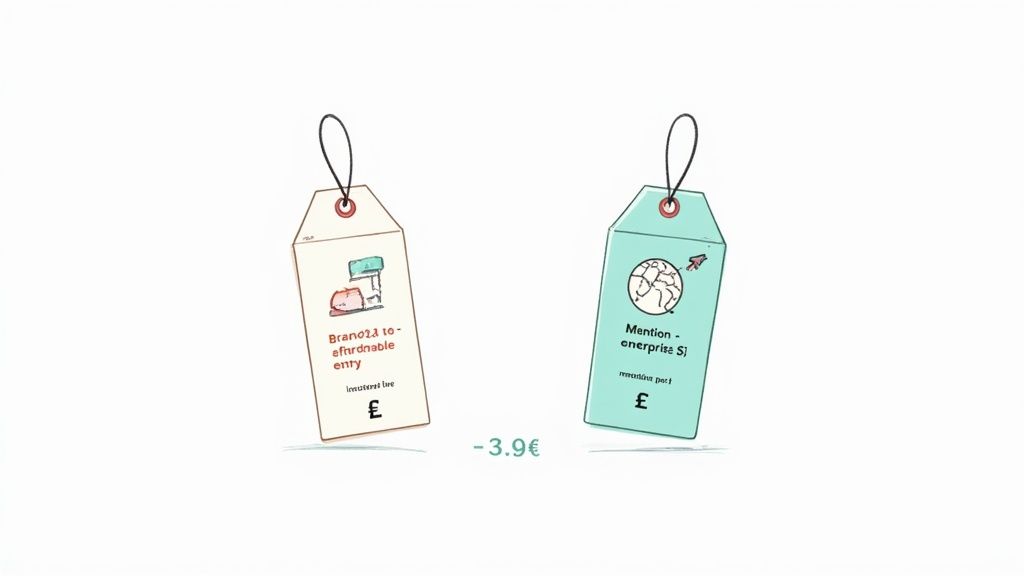

Talking about features and data is only half the story when comparing Brand24 vs Mention. For most businesses, especially here in the UK, the final decision usually comes down to price and whether you’re getting good value for your money. Both platforms use a tiered subscription model, but they have very different ideas about what you should get for your pound.

Brand24 pitches itself as an accessible but powerful solution, making it a great fit for UK SMEs and startups. Its entry-level plans are built to give you the core social listening tools you need without a scary price tag. This makes it a strong contender for businesses that need solid features but have to watch their marketing budget.

Mention, on the other hand, has a lower starting price for its most basic plan, but it’s really structured for scalability. As your needs grow, especially if you need more users or advanced features, the costs can ramp up. They often use custom pricing for their enterprise clients, which shows their focus on bigger, global organisations needing bespoke solutions.

Breaking Down The Tiers And Limits

A quick look at their entry-level plans shows the difference in strategy. Brand24’s ‘Individual’ plan is all about giving a single user or a tiny team a solid foundation to start monitoring effectively.

Mention’s ‘Solo’ plan is cheaper upfront but comes with tighter limits on keywords (which they call alerts). This is fine for freelancers or individuals with very specific, narrow monitoring needs. But the moment you need to track more keywords or bring on team members, you’ll be forced to upgrade.

The real value isn't just in the monthly cost, but in what each pound buys you. Consider the limits on keywords, mentions, and user seats—these are the metrics that will determine if a plan truly fits your workflow or forces a premature upgrade.

To get a clearer picture of how their plans stack up on key limits, let's break it down in a simple table.

Pricing And Feature Limits Comparison

This table compares the entry-level and mid-tier plans for Brand24 and Mention, highlighting the key differences in mentions, keywords, and user limits that will directly impact your day-to-day use.

| Metric | Brand24 (Individual/Team Plan) | Mention (Solo/Pro Plan) |

|---|---|---|

| Price | €89/€169 per month | €41/€83 per month |

| Mentions | 2,000/5,000 per month | 3,000/5,000 per month |

| Keywords/Alerts | 3/7 | 2/5 |

| Users | 1 user/Unlimited users | 1 user/Unlimited users |

| Update Frequency | Every 12 hours/Every 1 hour | Real-time/Real-time |

As you can see, Brand24's 'Team' plan stands out by offering unlimited users, a huge win for growing agencies or marketing departments. Mention reserves this for its more expensive plans, which can make collaboration costlier for smaller teams.

Calculating The True Cost Per Mention

To really understand the value, you have to look beyond the sticker price. UK companies often lean towards Brand24 for its cost-efficiency. While its base plan might seem to offer a modest number of mentions, the value comes from its highly targeted data. It pulls insights from 25 million sources that are often more relevant to UK businesses.

In contrast, Mention scans over 1 billion sources daily, which sounds impressive but can mean you’re paying for a lot of irrelevant noise, especially for local campaigns. Recent analysis shows this is a key factor in the UK, where 65% of Brand24's global customers are small businesses on tight budgets. Brand24's Individual plan, with 2,000 mentions and 3 keywords, is often a perfect fit for UK SMEs. If you want to dive deeper, you can discover more insights about social listening tool comparisons.

Ultimately, the right choice depends on your business size and where you’re headed.

- For UK SMEs & Startups: Brand24 usually offers better initial value. Its plans deliver core features like high-quality sentiment analysis and UK-focused source monitoring at a competitive price, with a clear and logical upgrade path.

- For Large & Global Enterprises: Mention’s scalable, customisable plans are built for the complex needs of international organisations. The higher cost is justified by its massive data coverage, advanced collaboration tools, and enterprise-level support.

Choosing the right plan means thinking ahead. If you expect your team to grow quickly, Brand24’s user seat model is far more forgiving. If your main goal is to monitor a huge range of global sources, Mention’s sheer data breadth might be worth the extra investment.

So, Which One Should You Choose?

Alright, we’ve picked apart the features, data, and pricing of both Brand24 and Mention. Now it’s time to cut through the noise and figure out which tool actually makes sense for your business. This isn't about finding a single "best" tool, but about matching the right platform to your specific needs.

Your decision really boils down to three simple questions: Where in the world is your audience? How much does the feeling behind a mention matter? And what’s your budget? The answers will point you in the right direction.

When to Pick Brand24

Brand24 really shines for a specific type of business, especially those focused on the UK market. It’s all about precision, usability, and getting a real feel for the emotions behind the mentions. Think of it as the tool for quality over sheer quantity.

You should seriously consider Brand24 if any of these sound familiar:

You're a UK-based SME or Startup: If your customers and competitors are primarily in the United Kingdom, Brand24’s focused source list will give you far more relevant, local data. Its pricing is approachable, and you won’t need a dedicated data scientist to make sense of the insights.

Reputation Management is Everything: Brand24's claim of 95% sentiment analysis accuracy is a huge deal. If your main goal is protecting your brand’s image, jumping on customer service issues, and truly understanding why people are happy or angry, its detailed emotion analysis is exactly what you need.

You Need a Simple Way to Track Performance: The Presence Score is a unique feature that I really like. It gives you a single, clear number to track your online authority against competitors, which makes reporting brand health to your boss or stakeholders incredibly straightforward.

Look, if your strategy hangs on understanding the emotional pulse of the UK market and you need a simple metric to prove your efforts are working, Brand24 was made for you. It delivers sharp, high-quality insights instead of drowning you in global data.

When to Go with Mention

Mention plays in a different league. It's built for scale, making it the clear winner for larger, more complex businesses with a global reach. Its whole setup is designed to hoover up massive amounts of data and support big, collaborative teams.

Choose Mention if your company looks more like this:

You're a Global Enterprise: With its ability to monitor over 1 billion sources in pretty much any language, Mention is the only real choice for tracking a global brand. If you need to know what’s being said in Tokyo, London, and São Paulo all at once, this is the tool that can handle it.

You Need to Look Back in Time: For analysing long-term trends or benchmarking campaigns over several years, Mention’s ability to pull up to 24 months of historical data is crucial. Brand24 just isn’t built for that kind of deep, historical dive.

Your Team Needs Serious Collaboration Tools: Mention’s built-in workflows, like social media approval queues and custom user permissions, are designed for large marketing departments or agencies juggling multiple clients. It brings structure and organisation to social listening at scale.

The Final Recommendation

To put it plainly, the choice comes down to a trade-off: focused precision versus massive scale.

For most UK businesses, from hungry startups to established SMEs, Brand24 offers the better value. The mix of affordable plans, top-notch sentiment accuracy, solid UK coverage, and a user-friendly interface gives you everything you need to manage your local reputation effectively. It cuts out the noise and delivers the insights that actually matter for a UK-focused company.

On the other hand, for huge multinational corporations and global agencies, Mention is the more capable and logical choice. Its enormous data coverage, deep historical archives, and powerful collaboration features are essential for managing complex, worldwide brand monitoring. The higher price tag is justified by its ability to operate on a global scale that Brand24 can’t touch.

By lining up your own business needs against these scenarios, you can confidently pick the platform that will do more than just collect data—it’ll give you the strategic insights you need to win.

Exploring ForumScout For Niche Community Monitoring

While the Brand24 vs Mention debate centres on big-picture social listening, what if your most valuable customer conversations are tucked away somewhere else entirely? For a lot of businesses, their best audience lives in niche communities like Reddit, Quora, and specialised industry forums—places where traditional tools often miss the mark.

This is where a more focused tool comes in. ForumScout was built for this exact challenge, acting as a powerful add-on or alternative for anyone who needs to dive deeper into these community-led discussions. Its real strength is its laser focus on conversations that the bigger platforms either ignore or just don't understand.

This screenshot shows just how simple it is to set up a keyword search in ForumScout, zeroing in on specific community sources.

The platform lets you target specific subreddits or forums, which means you only see mentions from the communities you actually care about.

Why Niche Monitoring Matters

For some industries, general social listening is just too noisy. A gaming company, for example, will get way more value from tracking feature requests in the r/Gaming subreddit than it will from sifting through millions of unrelated social posts. ForumScout is brilliant at this, helping you:

- Spot emerging trends: Find new ideas and pain points straight from passionate users before they go mainstream.

- Get honest feedback: Collect unfiltered opinions on your products from people who are actually using them.

- Engage a targeted audience: Jump into conversations where your ideal customers are already active and looking for advice.

By focusing on high-intent communities, you stop chasing simple brand mentions and start uncovering real, actionable intelligence. It's about finding the conversations that can directly shape your product, marketing, and sales strategies.

Instead of casting a wide, messy net, this approach gives you surgical precision. You can learn more about how to set up targeted forum monitoring and find out what your most dedicated customers are really saying. This kind of specialised monitoring isn't about replacing the big tools, but about adding a crucial layer to get a full picture of your online presence. For businesses whose customers live in these communities, it's a non-negotiable part of any modern listening strategy.

Your Questions, Answered

When you're weighing up two powerful tools like Brand24 and Mention, a few key questions always pop up. Let's get them answered so you can make a final call.

Which One Is a Better Fit for a Small UK Business?

For most small businesses in the UK, Brand24 is going to be the smarter choice. The pricing is far more accessible if you're working with a tight budget, and its data sources are nicely tuned for the UK market, covering local forums and news sites that matter.

Its sentiment analysis is also highly accurate (95%), and the interface is clean and simple. That means you can jump in, get a clear picture of your local reputation, and start managing customer feedback without paying for enterprise-level features you don't need from a tool like Mention.

Can I Track Specific Influencers with These Tools?

Yes, both platforms are great for identifying influencers, but they go about it in different ways. It really boils down to what you need to see.

- Brand24 gives you its own ‘Influence Score’. It’s a straightforward, at-a-glance ranking that shows you an author's impact, making it super easy to spot the most important voices in any conversation.

- Mention builds influencer metrics right into its main dashboard. It leans more on traditional stats like reach and engagement, giving you detailed data inside the author’s profile.

If you need to quickly rank and prioritise influencers, go with Brand24. If you'd rather dig into detailed profile data and engagement metrics without leaving the dashboard, Mention is your tool.

How Steep Is The Learning Curve For These Platforms?

This is a big one. The time it takes for your team to get comfortable with a new tool can make or break its value.

Brand24 is hands-down the more intuitive of the two. Its dashboard is clean and straightforward, so you can set up a project and start pulling in insights almost immediately. It’s built for teams that need to get moving fast, with very little training required.

Mention, on the other hand, has a slightly steeper learning curve because of its broader feature set and more complex query options. It's still user-friendly, but getting the most out of its advanced reporting and filtering tools will take a bit more time and practice. That said, this complexity is exactly what gives advanced users the flexibility they need for very specific monitoring tasks.

Ready to stop guessing what customers are saying and start turning conversations into revenue? ForumScout offers powerful, real-time monitoring with AI-powered filtering, sentiment analysis, and competitive insights, all at a fraction of the cost of legacy tools. Start your free 7-day trial today and find your next lead.