- 22 min read

How to Conduct a Competitor Analysis That Drives Growth

Trying to figure out your competition can feel like you're just gathering data for the sake of it. But a proper competitor analysis is so much more than a list of rival companies. Think of it as a playbook for finding their strategies, seeing what they're good at, and using their weaknesses to help you grow.

This guide will show you exactly how to run a competitor analysis that delivers real results.

Your Blueprint for Effective Competitor Analysis

Before you dive headfirst into spreadsheets and social listening tools, let's get one thing straight. A modern competitor analysis isn't about copying what others do. It's a methodical way to decode their playbook so you can build a better one.

This intro is your roadmap. It's here to make sure you start with a strategic mindset, not just a vague goal of "seeing what the competition is up to." When you're systematic about it, a good analysis delivers some serious wins for your business.

- Find Your Unique Place: Pinpoint what makes you different in a way that customers actually care about.

- Meet Customer Expectations: Your rivals are setting the standard for prices, delivery, and service. You have to meet that standard—or beat it.

- Discover Untapped Opportunities: You might find customer groups, product ideas, or service gaps that everyone else has missed.

- Identify Potential Risks Early: Spot threats like a brewing price war or a shift in customer tastes before they hit your bottom line.

A Framework for Action

To keep things from getting overwhelming, we've broken the whole process down into four clear phases. This structure is designed to prevent "analysis paralysis" by giving you a step-by-step path, from planning all the way to execution. Each phase builds on the one before it, turning raw information into a real competitive edge.

One of the biggest mistakes I see is people collecting data without a clear goal. The point isn't just to know what your competitors are doing; it's to understand why they're doing it and figure out how you can respond effectively.

To help you stay organised, here's a quick look at the framework we'll be following. It outlines what you're trying to achieve in each stage and the key tasks involved. Think of it as your cheat sheet for turning insights into action.

The Competitor Analysis Framework at a Glance

| Phase | Key Objective | Primary Activities |

|---|---|---|

| Phase 1: Planning | Define clear goals and identify relevant competitors to analyse. | Set specific objectives, identify direct and indirect rivals, and establish key performance indicators (KPIs). |

| Phase 2: Intelligence Gathering | Collect comprehensive data across digital and social channels. | Monitor social media mentions, track content performance, and analyse SEO strategies and share-of-voice. |

| Phase 3: Analysis | Interpret the collected data to uncover actionable insights. | Perform quantitative and qualitative analysis, identify patterns, and pinpoint competitor strengths and weaknesses. |

| Phase 4: Strategy & Action | Translate insights into a winning competitive strategy. | Create reports, develop strategic responses, and establish a plan for continuous monitoring and adaptation. |

Following this blueprint ensures you stay focused and ready to make decisive moves based on what you find.

Setting Your Goals and Identifying Key Competitors

Jumping into a competitor analysis without clear goals is like setting sail without a map. You’ll gather piles of data, but you won't know what to do with any of it. Before you start digging into rival websites and social feeds, you need to be crystal clear on what you want to achieve. A powerful analysis always starts with a sharp question.

Are you a startup trying to find a gap in the market? Perhaps you’re an established business looking to sharpen up your pricing strategy. Maybe your goal is just to figure out how competitors are using a new social platform to steal your audience's attention.

Without this focus, you’ll quickly hit "analysis paralysis"—drowning in information without a single actionable insight. Your goal shapes the entire project, from the data you collect to the conclusions you draw.

Defining Your Objectives

Your objectives have to be specific and measurable. Vague goals like "learn about competitors" won't get you anywhere. Instead, frame your goals around real business outcomes.

Here are a few practical examples for a small business:

- Improve Social Media Engagement: "Benchmark our Instagram engagement rate against our top three direct competitors to identify content strategies that generate more comments and shares."

- Identify Pricing Gaps: "Analyse competitor pricing for our core product line to see if there's an opportunity to adjust our prices or introduce a new pricing tier."

- Enhance Product Features: "Identify the top three most requested features on competitor review sites and forums that we don't currently offer."

Setting clear objectives like these from the outset ensures every bit of effort is focused on intelligence that will directly inform your business strategy.

Uncovering Your True Competitors

Once your goals are locked in, the next step is figuring out who you’re really up against. So many businesses make the mistake of only looking at the obvious players. A crucial first step is clearly defining who your rivals are; exploring resources dedicated to understanding your competitors can give you a massive head start.

Your competitive landscape is more complex than just the companies selling a similar product. It's best to think in tiers.

- Direct Competitors: These are the most obvious rivals. They sell a similar product to the same target audience. Think of them as the other team in your league, playing the same game for the same prize.

- Indirect Competitors: These businesses solve the same core customer problem but with a totally different solution. For example, a meal kit delivery service competes directly with other meal kit services, but indirectly with local restaurants and the ready-meal section at the supermarket.

- Aspirational Competitors: These are the brands you look up to. They might not even be in your direct market, but they absolutely nail something you want to improve, like brand building or customer service. They set the industry standard.

A common pitfall is ignoring what customers are actually saying. Your perceived competitors might not be the ones your audience compares you to. Social listening tools are invaluable here, as they reveal who your customers mention in the same breath as your brand.

For instance, using a tool like ForumScout lets you monitor conversations on platforms like Reddit or X. You can track mentions of your own brand alongside keywords related to customer problems. This often uncovers emerging or indirect competitors that weren't on your radar, giving you a much more accurate view of the battlefield.

By categorising your competitors this way, you can prioritise your analysis. You'll want to do a deep dive on your direct competitors, keep a close watch on indirect rivals, and draw inspiration from aspirational ones. Learning how to properly benchmark with competitors is a fundamental skill that turns this raw data into a real strategic advantage. This organised approach ensures you focus your limited time and resources on the rivals that pose the biggest threat or offer the most valuable lessons.

Gathering Intelligence Across the Digital Battlefield

Alright, you’ve got your objectives locked in and you know who you’re up against. Now it’s time to put on your detective hat. This is where the real work begins—moving past a quick glance at a competitor’s homepage to dig up the data that reveals their entire game plan.

Think of this as mapping out your rival’s movements. We’re going to collect actionable intelligence on their social media campaigns, content marketing pushes, and SEO tactics. The goal is to build a complete picture of their activities, not just a snapshot.

Monitoring Social Media and Brand Mentions

First things first, you need to go where the conversations are happening. Social media is an open book, showing you exactly how competitors talk to their audience, what content hits the mark, and—most importantly—what customers are really saying about them.

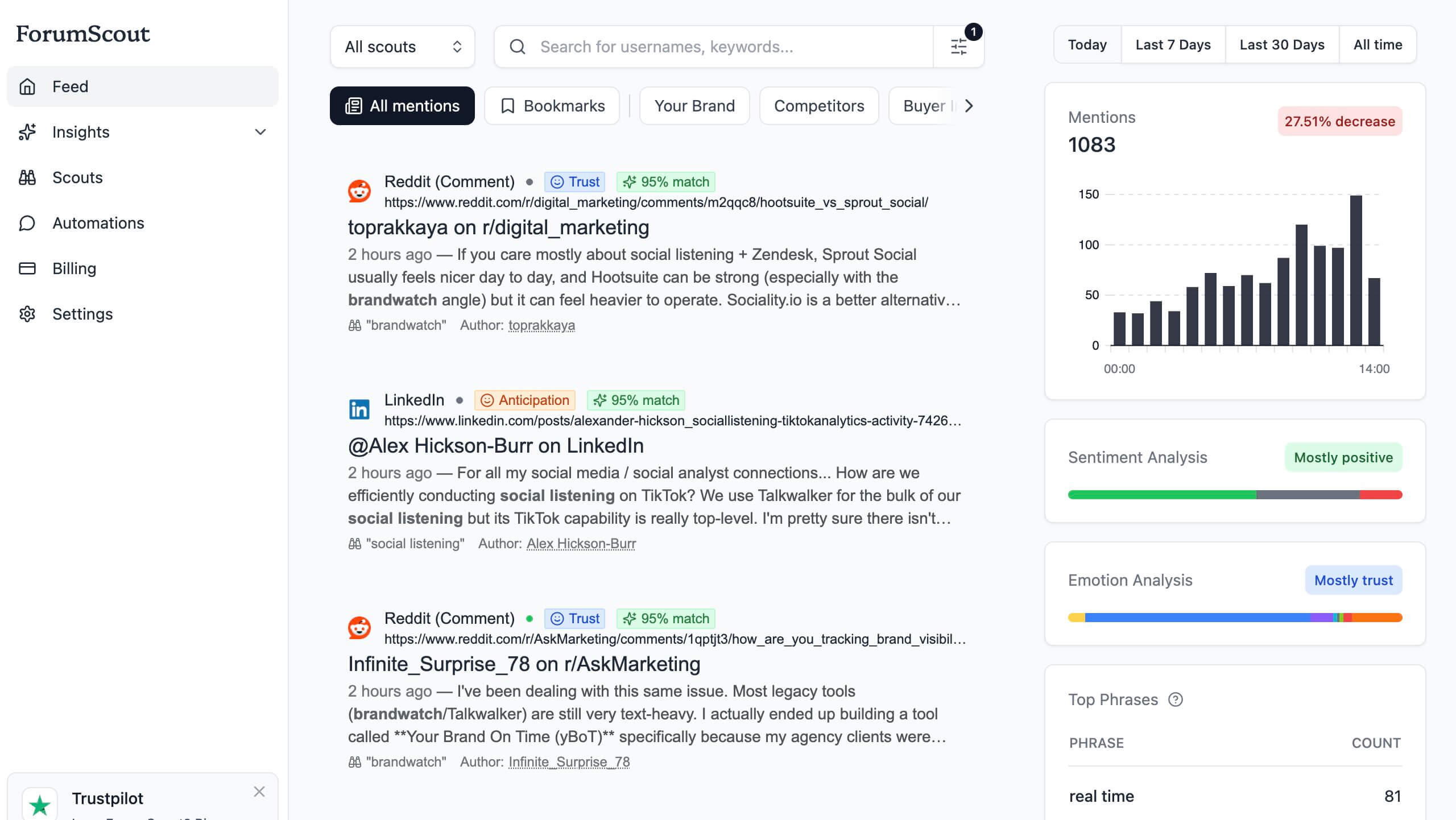

This is where a social listening tool like ForumScout becomes your best friend. You can set up trackers for competitor brand names, specific products, and even their key executives. This automates the whole process, pulling in mentions from places like Reddit, X, and Facebook so you have a constant stream of intel.

Here’s a look at how you can use keyword tracking to keep tabs on competitor mentions and related topics, making sure no critical conversation slips through the cracks.

This kind of dashboard view lets you see at a glance where and how often your competitors pop up in discussions, which is the perfect starting point for your analysis.

For UK businesses, understanding a competitor's social media game is critical, especially when you consider Facebook’s dominance. With approximately 68% of the social media market share in the United Kingdom, it’s a non-negotiable platform to monitor. This approach lets you see not just what your rivals are doing, but how their audience is reacting, which is gold for making smarter strategic decisions.

Analysing Content Marketing and Messaging

Beyond tracking mentions, you need to get into the weeds of the content your competitors are actively creating. This is how you figure out their core messaging, who they’re trying to talk to, and what topics they’re betting on.

Start by digging into their: * Blog Posts and Articles: What subjects do they write about most often? What’s the tone like? Is the quality any good? * Video Content: Are they all-in on YouTube or are they killing it with short-form clips on TikTok? Look at what formats get the most engagement—tutorials, testimonials, or behind-the-scenes stuff. * Lead Magnets: Are they offering ebooks, whitepapers, or webinars? This is a dead giveaway for how they’re capturing leads at the top of the funnel.

This isn’t just about seeing what they’re doing; it's about spotting the gaps. If they’re completely ignoring a major customer pain point on their blog, that’s your opening to own that conversation. For a deeper look at this process, check out our guide on how to perform a detailed https://forumscout.app/blog/social-media-competitive-analysis.

The goal isn’t to copy your competitor’s content calendar. It’s to understand the strategy behind their content—who they're trying to reach and what they want that audience to do next.

Deconstructing Their SEO and Search Strategy

A competitor's SEO strategy is like a window directly into their customer acquisition priorities. By seeing which keywords they target, you can figure out exactly which problems they’re trying to solve and how they’re positioning themselves to be the solution.

When you're gathering intelligence, having the right arsenal is key; exploring the best AI SEO tools can give you a serious leg up in understanding and outmanoeuvring the competition. These tools can uncover crucial data points in minutes.

Here's what to look for: * Target Keywords: Which commercial and informational keywords are they ranking for? This shows you where they’re focusing their energy to pull in organic traffic. * Backlink Profile: Who is linking to them? High-quality backlinks from authoritative sites are a huge indicator of a strong reputation and a cornerstone of any good SEO campaign. * Paid Search Ads: Are they running Google Ads? Their ad copy and the keywords they’re bidding on will tell you exactly which customer segments they find most profitable.

By gathering all this data, you're doing more than just spying. You’re building a comprehensive intelligence file. This 360-degree view of their social presence, content machine, and search visibility is the raw material you'll use to find the actionable insights that will power your own growth.

From Data Piles to Actionable Insights

So, you’ve gathered all that competitor intelligence. What you’re looking at now is a mountain of raw data, and on its own, it’s just noise. The real magic happens when you start connecting the dots, turning numbers and observations into a clear story that can actually drive your strategy forward.

This is where your analysis shifts from just collecting data to generating real insights. It boils down to two distinct but complementary approaches: looking at the hard numbers (quantitative analysis) and understanding the story behind them (qualitative analysis).

Benchmarking with Quantitative Data

Quantitative analysis is all about measurement. It’s where you benchmark your performance against your competitors using specific, objective key performance indicators (KPIs). This gives you a clear, data-backed view of exactly where you stand in the market.

The KPIs you choose should tie directly back to the goals you set at the very beginning. If your main objective was to increase brand awareness, you’ll want to focus on metrics like share of voice. If you were aiming to boost engagement, you’d zero in on social interaction rates instead.

It’s easy to get lost in a sea of metrics, so let’s build a simple framework for choosing the right ones.

Choosing the Right KPIs for Your Competitor Analysis

| Metric Category | Example KPIs | What This Tells You |

|---|---|---|

| Audience & Reach | Follower Count, Website Traffic, Keyword Rankings | The size and source of their audience. Are they winning at SEO, social, or paid ads? |

| Engagement | Likes, Comments, Shares, Engagement Rate | How connected their audience is. High followers with low engagement is a red flag. |

| Conversation | Share of Voice (SoV), Brand Mentions, Sentiment | Who owns the conversation in your niche and how people feel about them. |

| Content Performance | Top Performing Posts, Content Formats, Publishing Frequency | What content resonates with their audience and how consistently they are publishing. |

Each metric gives you a different piece of the puzzle, helping you see not just if a competitor is succeeding, but how.

Here are a few essential metrics we always recommend tracking:

- Share of Voice (SoV): This measures how much of the online conversation about your industry your brand owns compared to competitors. Tools like ForumScout can calculate this automatically, showing you who’s dominating the discussion. For a much deeper dive, check out our guide on share of voice measurement.

- Engagement Rate: Don't get distracted by huge follower counts. Instead, analyse the percentage of a competitor's audience that actually interacts with their content. A massive following with low engagement often signals a disengaged or even fake community.

- Keyword Rankings: Keep an eye on where your top competitors rank for your most important keywords. This reveals their SEO priorities and highlights opportunities for you to outrank them.

- Website Traffic and Sources: Use analytics tools to estimate a competitor's website traffic and see where it's coming from—organic search, social media, paid ads, or referrals.

Getting to the 'Why' with Qualitative Insights

While numbers tell you what is happening, qualitative analysis tells you why. This is where you step away from the spreadsheets to assess the quality of your competitors' strategies, messaging, and market positioning.

The most powerful insights often come from blending the quantitative with the qualitative. Knowing a competitor’s campaign got a 20% higher engagement rate is useful. Knowing it’s because their messaging resonated with a specific customer pain point you've been ignoring is a game-changer.

This deeper analysis means digging into the nuances. For example, if a competitor has a high share of voice, a qualitative lens would ask: Is the sentiment of those mentions positive or negative? Are they seen as an authority, or are they just making a lot of noise?

This is exactly where features like sentiment analysis in tools like ForumScout become so valuable. They don't just count mentions; they analyse the emotional tone behind them, helping you understand public perception and the real story behind the data.

Spotting Patterns and Untapped Opportunities

As you start blending both types of analysis, patterns will emerge. You might notice one competitor consistently smashes it with video content but completely neglects their blog. Or maybe you’ll find a rival whose brand messaging is all over the place across different social platforms.

These patterns are your road signs pointing towards strategic openings.

For instance, the huge growth in UK digital advertising, which now makes up over 80% of the country's total ad spend, has created an incredibly crowded space. With UK social media ad spend projected to hit £9.02 billion in 2025, competitors are pouring money into the platforms where your audience lives. By tracking their paid campaigns and influencer partnerships—a market now worth £930 million—you can see exactly where they're spending and what messaging they're pushing. This helps you find a smarter, more effective way to allocate your own budget. You can discover more about UK digital trends and what they mean for your strategy here.

Your goal in this analysis phase is to pull everything you’ve learned into a coherent narrative. You should be able to clearly articulate each competitor's core strategy, identify their biggest strengths, pinpoint their exploitable weaknesses, and recognise the untapped opportunities just waiting for you to seize them. This story is what you'll use to build a winning strategy.

Turning Your Insights Into a Winning Strategy

An analysis, no matter how detailed, is only valuable if it leads to action. You’ve gathered the intelligence and connected the dots; now it’s time to translate that hard-won knowledge into a concrete competitive strategy that gives you an edge. This is where your research moves off the spreadsheet and into the real world.

First things first, you need to share what you’ve found. But nobody wants to read a 50-page report. It’ll just gather dust. Instead, focus on creating a clear, compelling report or an interactive dashboard that tells a story. Visualise your key findings—use charts for share-of-voice trends, tables for feature comparisons, and word clouds for customer sentiment.

This isn't just about presenting data; it's about making a case for change. Every insight should be paired with a direct recommendation. For example, "Competitor X's positive sentiment shot up 30% after they launched their TikTok campaign, so we should prioritise developing a short-form video strategy." It's simple, direct, and actionable.

From Insights to Informed Decisions

With your findings clearly laid out, you can start making smarter decisions across the entire business. A thorough competitor analysis should influence far more than just your marketing campaigns. It’s a strategic tool that can guide everything from product development to customer support.

Consider these practical applications: * Refine Your Marketing Messaging: If your analysis shows a competitor is failing to address a specific customer pain point, that’s your opening. Adjust your ad copy, website content, and social media posts to highlight how you solve that exact problem. * Prioritise Your Product Roadmap: Did you uncover a highly requested feature on competitor forums that they are ignoring? This is a clear signal from the market. Use this insight to bump that feature up your development priority list. * Optimise Your Pricing Strategy: If your rivals are all fighting at the high end, maybe there's an untapped opportunity for a more affordable, entry-level offering. On the other hand, if their customers constantly complain about poor quality, you may have justification to position yourself as a premium, more reliable alternative.

For UK businesses targeting growth, understanding how competitors talk to younger demographics is crucial. Social media reaches 97-98% of Gen Z and Millennial internet users in the UK. With 94% of people under 24 using a social platform daily, this is where brand loyalty is won or lost. Competitors are heavily invested here, but their strategies vary across platforms like YouTube (54.8 million UK users) and TikTok (24.8 million users aged 18+). By analysing their messaging on these youth-focused channels, you can discover what resonates and position your brand to win over the next generation of customers. You can learn more about UK social media trends and their impact on business here.

Establishing a Continuous Monitoring Plan

The competitive landscape is never static. A new rival can pop up, an existing one can pivot their strategy, or a market trend can shift customer expectations almost overnight. That’s why your analysis can't be a one-off project. To maintain your advantage, you need to turn it into an ongoing process.

A one-time analysis gives you a snapshot. Continuous monitoring gives you a motion picture. It lets you anticipate your competitors' next moves instead of just reacting to them.

This doesn't mean you need to conduct a massive deep-dive every month. That’s not sustainable. Instead, set up a simple framework for continuous tracking. This is where a tool like ForumScout becomes indispensable.

Here’s a simple framework for ongoing monitoring: 1. Automate Your Alerts: Set up automated notifications in ForumScout for competitor brand mentions, key industry terms, and new product announcements. This ensures you’re the first to know when something important happens. 2. Schedule Quarterly Reviews: Dedicate time each quarter to refresh your core analysis. Re-evaluate KPIs like share of voice, check for shifts in messaging, and update your SWOT analysis. 3. Conduct Annual Deep Dives: Once a year, perform a full-scale competitor analysis to reassess your overall strategy and account for major market changes.

By embedding this process into your operations, you transform your competitor analysis from a reactive research project into a proactive strategic weapon. This continuous loop of gathering intelligence, analysing insights, and taking action is the key to not just competing, but leading in your market.

Your Competitor Analysis Questions, Answered

Even with the best playbook, questions are going to come up. Competitor analysis is a complex beast, and it's easy to get lost in the weeds or wonder if you're even on the right track. Let’s clear up some of the most common questions I hear.

Getting these fundamentals right is what turns a one-off research project into a genuine, sustainable advantage for your business.

How Often Should I Run a Competitor Analysis?

This is the classic question, and the honest answer is: it depends entirely on your industry. There's no magic number here.

If you’re in a fast-paced space like e-commerce, consumer tech, or SaaS, the market can shift dramatically in a matter of weeks. A comprehensive deep-dive every quarter is a smart move. Waiting a full year to check in would be like showing up to a race after everyone else has finished. For more stable industries, a thorough analysis every six to twelve months might be all you need.

The real key is to stop thinking of competitor analysis as a single event. It’s an ongoing process. A deep-dive gives you a strategic baseline, but continuous monitoring is what keeps you agile.

The best approach is to pair your periodic deep-dives with a continuous monitoring system. Use a social listening tool to set up automated alerts for major competitor announcements, new campaign launches, or a sudden spike in negative feedback. This way, you’re always aware of the big moves without having to do a full-blown analysis every other week.

What Are the Biggest Mistakes People Make?

So many businesses fall into the same traps when they start out. Knowing what they are from the get-go will save you a ton of time and frustration down the line.

By far, the biggest mistake is collecting data without a clear objective. This is the fast track to "analysis paralysis," where you're drowning in spreadsheets with zero clue what any of it actually means. Always, always start with a specific question you need to answer.

A few other common pitfalls to watch out for: * Wearing blinkers. Focusing only on your direct competitors is a massive oversight. You need to keep an eye on the emerging rivals and the indirect players who are solving the same customer problem in a totally different way. * Relying on one source of truth. A single data point tells a single story. A truly comprehensive view comes from blending intelligence from social media, SEO tools, customer reviews, and website analytics. * Treating it like a school project. The goal isn't to create a beautiful, perfect report to sit on a shelf. It's to generate actionable insights that directly shape your business decisions and drive real growth.

How Can I Do This on a Limited Budget?

A tight budget is a reality for most small businesses, but it absolutely doesn't mean you have to fly blind. You can run an effective competitor analysis without breaking the bank.

Start by squeezing every last drop of value out of free tools. Set up Google Alerts for your competitors' names. Use the free versions of SEO tools to get a basic look at their keywords and backlinks. And, of course, you can manually scroll through their social feeds and read customer reviews on public sites.

But honestly, the biggest budget-friendly leap you can make is investing in an affordable social listening platform. Manual data collection is brutally time-consuming, and your time is valuable.

For a small monthly investment, a tool like ForumScout can automate all that heavy lifting. The Growth plan, for instance, gives you access to a massive volume of mentions and sophisticated AI filtering for a ridiculously low cost. It automates the kind of data collection that would be impossible to manage manually on a budget, giving you a serious edge.

What's the Difference Between Competitor Analysis and Market Research?

This is a crucial distinction. While they're closely related and often overlap, they have fundamentally different scopes.

Think of it like this: Market research is about understanding the entire "playing field." It’s the broad, high-level process of analysing customer needs, spotting demographic trends, and figuring out the overall size and potential of the market.

Competitor analysis, on the other hand, is a specific part of that research. It focuses exclusively on the other "teams" on that field. The goal is to get inside your rivals' heads—to understand their strategies, strengths, and weaknesses so you can position your own business to win.

Ready to stop guessing what your competitors are up to? ForumScout gives you the tools to monitor their every move, understand customer sentiment, and find your winning edge. Start your free 7-day trial and turn conversations into revenue.