- 20 min read

Talkwalker vs Brandwatch in 2026

So, what’s the real difference between Talkwalker and Brandwatch? At its core, it comes down to this: Talkwalker shines with its sheer global reach and an interface that gets you to insights quickly. Brandwatch, on the other hand, is all about depth—unmatched historical data and custom analytics for deep-dive research.

Choosing Your Social Intelligence Partner

Let's be honest, trying to understand online conversations without the right tool is like navigating a maze blindfolded. For any business that wants to stay relevant, it's non-negotiable. This guide cuts straight to the chase, comparing Talkwalker and Brandwatch, two of the heaviest hitters in the enterprise social intelligence space. We're moving past the glossy feature lists to give you a real, nuanced look at where each one truly excels.

Our goal is to give you the practical knowledge you need to pick the platform that actually fits your strategy, not just the one with the biggest marketing budget. But before we get into the weeds, let's start with a high-level view.

Talkwalker's homepage, for instance, puts its focus on "consumer intelligence" front and centre, showing how it bridges the gap between raw social data and tangible business results.

It’s a clear message: they’re positioned to turn the chaos of online chatter into strategic insights that everyone from marketing to product development can actually use.

Talkwalker vs Brandwatch At a Glance

To kick things off, this table breaks down the core differences between the two platforms. Think of it as your cheat sheet for understanding who they’re built for and what they do best.

| Feature | Talkwalker | Brandwatch |

|---|---|---|

| Primary Strength | Expansive global data coverage and an intuitive, user-friendly interface. | Unparalleled depth in historical data and highly customisable analytics. |

| Best For | Global brands, PR teams, and marketing departments needing fast insights. | Market researchers, data analysts, and teams focused on long-term trends. |

| User Experience | Streamlined and accessible, designed for quick adoption by diverse teams. | Powerful but more complex, often requiring dedicated analysts to maximise. |

| Data Focus | Real-time, multi-language monitoring across 150 million+ sources. | Deep historical archives and advanced query building for specific research. |

This snapshot gives you a starting point, but the real story is in the details. As we dive into their data sources, AI capabilities, and pricing models, you'll get a much clearer picture of which tool is the right investment for your team's specific needs.

Comparing Data Sources and Global Reach

The real muscle behind any social intelligence platform is the data it pulls in. When you stack up Talkwalker against Brandwatch, the sheer scope and quality of their data are what set them apart. This directly shapes the insights you can get, and your choice boils down to a simple question: do you need real-time global breadth, or deep historical analysis?

Talkwalker goes for volume and variety, casting an incredibly wide net to catch conversations as they happen, wherever they happen. It's built for brands with a serious international footprint.

Brandwatch, on the other hand, zeroes in on providing unparalleled depth, especially with its historical data archives. While its source count is still huge, its trump card is the ability to look back years to understand how markets or brand perceptions have evolved over time.

Talkwalker’s Dominance in Global and Multilingual Coverage

For UK companies pushing into Europe, Asia, or the Americas, understanding local conversations isn't a "nice-to-have"—it's a must. Talkwalker is built precisely for this, offering coverage that’s both massive and linguistically diverse.

The numbers really tell the story here. Talkwalker covers over 150 million websites in 187 languages, while Brandwatch tracks 100 million+ sources in just 40 languages. This is a game-changer for UK brands, where exports make up 45% of GDP. Think of giants like Unilever or Burberry; they need to track mentions everywhere. Talkwalker reportedly captured over 5 million UK-related conversations in Q1 2025 alone, a 30% jump from 2024 as post-Brexit trade dynamics shifted. You can even see how Talkwalker positions itself as a strong Brandwatch alternative.

Key Insight: Talkwalker's huge language support isn't just a vanity metric. It means its sentiment analysis and topic detection are properly tuned for local dialects and cultural quirks, giving you far more accurate insights in non-English speaking markets.

Picture a UK fashion house launching a new line in London, Paris, and Tokyo at the same time. With Talkwalker, their team can watch reactions unfold in real-time on local social networks, blogs, and news sites in English, French, and Japanese—all from one dashboard. It’s perfect for making quick messaging tweaks or handling localised issues on the fly.

Brandwatch’s Strength in Historical Data Archives

While Talkwalker is the king of real-time global monitoring, Brandwatch has a clear edge for anyone needing deep, retrospective analysis. Its access to extensive historical data archives is a massive asset for market researchers, academics, and strategists studying long-term trends.

This feature lets you benchmark brand health against past performance, analyse how consumer behaviour has changed over a decade, or dig into the origins of a market trend.

A financial services firm, for example, could use Brandwatch to analyse ten years of conversations around "ethical investing" to see how public perception has shifted. That kind of deep historical query is exactly where Brandwatch’s architecture shines, offering a level of research depth that few others can match.

Ultimately, your best bet depends entirely on what you’re trying to achieve.

-

Choose Talkwalker if: Your main job is real-time monitoring of a global brand, managing international campaigns, or putting out fires across different languages and regions.

-

Choose Brandwatch if: Your work involves in-depth market research, academic studies, or long-term strategic planning that depends on analysing historical data trends.

Putting AI-Powered Analytics and Insights Under the Microscope

Let's get past the basic keyword tracking. The real magic in the Talkwalker vs Brandwatch showdown happens inside their AI engines. This is where the platforms stop being simple data collectors and start becoming strategic intelligence tools, turning the messy chaos of online conversation into something you can actually use. Both have impressive sentiment analysis, but they take different routes to get there, and their standout features will appeal to different teams.

At their core, these AI systems are built to make sense of huge volumes of unstructured text and media. It's worth getting your head around how to analyze qualitative research data effectively just to appreciate the sheer amount of heavy lifting these platforms do in the background.

Talkwalker’s Edge: Visual Analytics and Real-World Context

Talkwalker has poured a ton of resources into its visual analytics, and it shows. This is where it pulls ahead, giving you a complete picture of your brand's presence. Its AI can spot logos, objects, and even specific scenes in photos and videos from over 30,000 brands, even when your brand name isn't mentioned anywhere in the text.

Frankly, this is a massive leap from old-school text monitoring. It lets you capture the unprompted, organic visibility your brand gets out in the wild.

- Logo Recognition: Think spotting your logo on a celebrity’s t-shirt at a music festival or in the background of a random TikTok video.

- Object & Scene Detection: A food brand could track images tagged with "family picnic" or "summer barbecue" to see their products in action, which is gold dust for planning future campaigns.

Real-World Scenario: Picture a UK-based sportswear brand sponsoring the London Marathon. With Talkwalker's visual AI, they can actually count how often their logo appears in spectator photos and social media clips. This gives them a far more accurate ROI on their sponsorship—something text-only analysis would completely miss.

This tech gives you a much more authentic read on your earned media value. It’s less about what people say about you and more about how they use and show your brand in their lives.

Brandwatch’s Forte: Deep-Dive Sentiment and Audience AI

While Talkwalker owns the visual space, Brandwatch is the master of dissecting text-based conversations with its beast of an AI, Iris™. Brandwatch goes way beyond a simple positive-negative-neutral score.

It lets you slice and dice sentiment by topic, author, or demographic, giving you a layered understanding of how people see your brand. This is incredibly useful for figuring out who is saying what and, more importantly, why they feel that way.

- Granular Sentiment: You could find that sentiment for your brand is positive overall, but there’s a pocket of intense negativity specifically around "customer service."

- Demographic Insights: The AI is smart enough to infer demographic data—age, gender, location, even interests—from author bios and language patterns, helping you build incredibly detailed audience profiles.

- Trend Forecasting: Brandwatch’s AI is also pretty sharp at spotting emerging trends and predicting where they might go, giving strategists a valuable head-start.

The platform’s real strength is adding rich, qualitative texture to your quantitative data. For example, a consumer goods company could analyse sentiment around its new packaging not just as a whole, but specifically among women aged 25-34 in the North of England. That level of detail is priceless for targeted marketing. If you’re curious about how this tech works across the industry, our guide on AI social listening tools gives a broader view.

So, what’s the verdict? It really boils down to what you need. If your brand lives and breathes through its visual identity and real-world presence, Talkwalker’s AI is a game-changer. But if your strategy hinges on deep audience segmentation and understanding the subtle nuances of consumer opinion, Brandwatch’s analytical depth is second to none.

Which Tool Is Easier to Use and Get Your Team Onboard With?

Even the most powerful social intelligence platform is a waste of money if your team finds it too clunky to actually use. When comparing Talkwalker and Brandwatch, usability and team adoption are huge differentiators that directly impact your return on investment. The best tool is the one that gets used, and each platform tackles this challenge from a completely different angle.

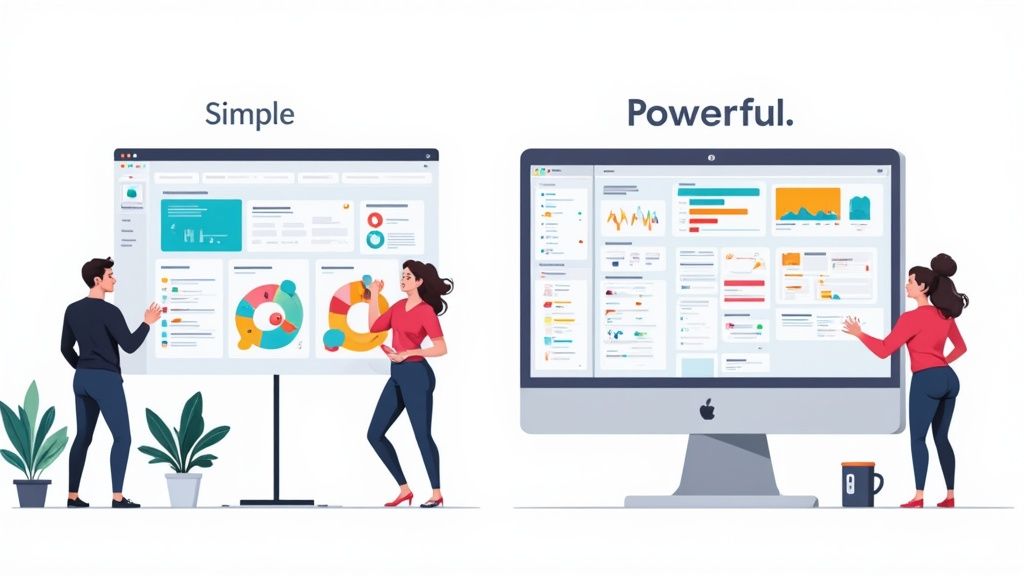

This image perfectly captures the core difference in philosophy. Talkwalker goes for a clean, streamlined dashboard designed for quick insights, while Brandwatch offers a dense, highly customisable view built for deep-dive analysis. This visual contrast really sets the stage for how easily different teams will get to grips with each tool.

Talkwalker’s Focus on Intuitive Design and Quick Onboarding

Talkwalker is widely known for its clean, intuitive user interface. It’s built to lower the barrier to entry, so a broader range of team members—from PR specialists to marketing managers—can pull meaningful insights without needing a data science degree.

This emphasis on usability means teams can get up and running much, much faster. Dashboards are logically laid out, and everyday tasks like setting up queries or building reports are refreshingly straightforward. This approach is perfect for agile organisations that need to move quickly and can't afford a steep learning curve or hire a full-time analyst just to run a single tool.

User sentiment strongly backs this up. In the competitive space of social listening tools for UK businesses, Talkwalker has earned significantly higher user satisfaction than Brandwatch. Aggregated review data shows Talkwalker with a solid 4.3 out of 5 from 20 reviews, while Brandwatch trails with an average of just 2.93 from 15 reviews. Digging in, Talkwalker received 19 positive ratings versus only 1 negative—a stark contrast to Brandwatch's 8 positive and 7 negative reviews. You can see a detailed breakdown of this Talkwalker vs Brandwatch analysis for more user feedback.

A senior marketing manager at a global CPG firm told us, "With Talkwalker, I could train our junior staff in an afternoon. Within a week, they were independently tracking campaign performance and flagging potential issues. That speed is invaluable."

This ease of use translates directly into wider team adoption. When a tool is accessible, it becomes a shared resource rather than a siloed function, helping to build a more data-informed culture across the entire organisation.

Brandwatch’s Powerful but Complex Interface

Brandwatch, on the other hand, is a powerhouse built for the dedicated analyst. Its interface offers a far greater degree of customisation and query-building complexity, which is a massive advantage for users who need to conduct highly specific, granular research. But this power comes at the cost of simplicity.

The learning curve for Brandwatch is considerably steeper. New users often need extensive training and ongoing practice to unlock its full potential. The sheer number of filters, operators, and dashboard configurations can be overwhelming for anyone who isn't living in the platform day in and day out.

This structure makes Brandwatch a better fit for organisations with a dedicated insights or market research team. These specialists can get the most out of the platform's complexity to build incredibly detailed queries and sophisticated reports that answer very specific business questions. For a general marketing team, however, it can feel like using a sledgehammer to crack a nut, which often leads to lower adoption rates outside of the core analyst group.

- Choose Talkwalker for: Teams that prioritise speed, ease of use, and broad adoption across multiple departments (Marketing, PR, Communications).

- Choose Brandwatch for: Organisations with dedicated data analysts or research teams who require deep customisation and can invest in specialised training.

Breaking Down Pricing and Total Value

Trying to pin down the cost of enterprise tools like Talkwalker and Brandwatch can feel a bit like navigating in the dark. Neither platform puts a price tag on their website. Instead, both work on a custom quote model, building a package around what you actually need. But this is where their philosophies split, and comparing them on cost alone misses the point. You need to look at what your investment truly gets you.

For either platform, you're typically looking at an investment starting in the low five figures annually. This can climb quickly depending on how much data you need, how many users you have, and which features you unlock. When you're weighing Talkwalker vs Brandwatch on price, the quote is just the beginning; the real question is about the total value.

Talkwalker’s Comprehensive Value Package

Talkwalker’s approach is to give you everything in one big, powerful package. Their pricing is built around the idea of an all-inclusive solution, meaning advanced features are usually part of the core deal, not expensive extras. Things like their visual analytics, massive language support, and huge library of data sources are baked right in.

This model is a huge plus for organisations that need a wide set of tools and don't want to get nickel-and-dimed every time they need a new feature. For a global UK business, it makes budgeting much simpler. It guarantees that teams across the company can monitor campaigns, handle reputation management, and find insights without running into surprise paywalls.

Key Takeaway: Talkwalker follows a 'more-is-more' philosophy. You pay for a comprehensive, powerful platform where key strengths like global data and visual AI come as standard. This means predictable costs and immediate access to a massive feature set.

Brandwatch’s Modular and A La Carte Approach

Brandwatch, on the other hand, often takes a more modular route. Their core platform is incredibly powerful, no doubt about it. But if you want specialised features, deeper historical data, or access to specific data sources, you'll likely need to bolt them on as separate modules. This a la carte style can be perfect for organisations with very specific, targeted needs.

For example, a market research firm needing ten years of historical Twitter data for a single project might find this model more budget-friendly. They pay for exactly what they need, and nothing more. The risk, however, is for businesses whose needs are constantly changing. This model can lead to costs creeping up over time as you add more and more functionality. It’s a common pattern with enterprise tools, something we covered in our Meltwater vs Brandwatch breakdown.

Determining the Best Return on Investment

So, which one is right for you? It really comes down to your strategic goals and how your teams operate.

- Talkwalker offers better ROI for: Global brands that need extensive, real-time monitoring across tons of languages and media types. The all-inclusive package delivers better long-term value for diverse, fast-moving teams.

- Brandwatch provides stronger ROI for: Niche use cases, like academic research or specialised consulting projects, where the main goal is deep but narrow data access.

To get a feel for how these costs stack up in the wider market, it’s worth understanding the pricing models of other platforms like Sprout Social. Having that context makes it clearer how different vendors package their value. At the end of the day, the best value isn't just the lowest price—it's the model that grows with you, so your costs don't spiral out of control as your intelligence needs get more complex.

Making Your Final Decision

Choosing between Talkwalker and Brandwatch isn't just about picking a tool; it's about finding a strategic partner that fits neatly into your team's daily workflow and helps you hit your long-term goals. The right platform really depends on who you are and what you're trying to achieve. Let's break it down by persona to make things clearer.

This decision framework should help you see which platform’s strengths will best solve your unique business challenges. Both tools are incredibly powerful, but they are built for different masters.

The Global Marketing Manager Verdict

If you’re a marketing manager at a global company, your world is a whirlwind of international campaigns and multiple regions. You need to keep an eye on brand health in various languages and report back on performance quickly, without getting stuck building complicated queries.

Recommendation: Talkwalker

Talkwalker was practically built for this. Its huge data coverage, extensive language support, and genuinely intuitive interface mean your entire team can get up to speed without a massive learning curve. The visual analytics are a game-changer, too, giving you a true sense of your brand's presence by catching logo placements that text-only tools would completely miss.

The Dedicated Market Researcher Verdict

As a market researcher or data analyst, you care more about depth than speed. Your job is to uncover long-term trends, make sense of historical market shifts, and construct incredibly specific queries to answer complex business questions.

Recommendation: Brandwatch

Brandwatch is the clear winner here. Its access to deep historical data archives is second to none, letting you run retrospective analyses that are impossible on most other platforms. For you, the complexity of its query builder is a feature, not a flaw. It gives you the granular control needed for rigorous, almost academic-level research.

The Strategic Alternative for Niche Insights

But what if your needs are more focused? Enterprise tools are a serious investment, and sometimes you just need precise insights without the enterprise price tag. For businesses focused on deep community and forum intelligence—tracking conversations on Reddit, niche forums, and news sites—a more targeted solution is often a much better fit.

For teams prioritising community engagement and lead generation from forums, a tool like ForumScout offers a cost-effective and powerful alternative. It's designed to find actionable conversations in places legacy tools often overlook.

If your main goal is to tap into authentic user discussions and find sales opportunities within online communities, a specialised tool will deliver a much higher ROI. You can find more details on this approach by exploring some of the best Talkwalker alternatives available today.

Which Tool Is Right for You?

So, how do you decide? The best choice comes down to your primary goals, team structure, and budget. This table breaks down the most common scenarios to help you find the perfect fit.

| Your Primary Need | Recommended Tool | Why It's The Best Fit |

|---|---|---|

| Real-time, global brand monitoring | Talkwalker | Its speed, broad data coverage, and user-friendly interface are ideal for fast-paced, international marketing teams who need immediate insights. |

| Deep, historical market research | Brandwatch | Unmatched historical data access and a powerful query builder make it the top choice for analysts conducting in-depth, long-term studies. |

| Niche community and forum tracking | ForumScout | A cost-effective and focused solution for SMBs and agencies wanting to find sales leads and user feedback on platforms like Reddit and niche forums. |

| User-friendly team collaboration | Talkwalker | The intuitive dashboards and visual analytics make it easy for entire teams to adopt and use, regardless of technical skill. |

| Complex, granular data analysis | Brandwatch | If your team is comfortable with Boolean logic and needs to answer highly specific research questions, Brandwatch offers unparalleled control. |

Ultimately, the Talkwalker vs Brandwatch debate resolves itself once you define your core mission. For broad, real-time, global monitoring, Talkwalker is the modern enterprise choice. For deep, historical, specialised research, Brandwatch remains a formidable tool. And for targeted community intelligence, specialised platforms provide a much smarter path forward.

Burning Questions: Talkwalker vs. Brandwatch

When you're weighing up two enterprise-level tools like these, a few specific questions always come to the surface. Let's tackle the most common ones to give you a clearer path forward.

Which is Better for Crisis Management?

For putting out fires in real time, Talkwalker generally has the edge. Its alert system is faster, and its whole approach to data feels more immediate. We’ve seen PR teams use it to spot a spike in negative comments and jump on the issue before it turns into a full-blown crisis.

Brandwatch can certainly do the job, but its real power is in the deep-dive analysis after an event. If you need a super-responsive, early-warning system that tells you something’s wrong right now, Talkwalker’s architecture is built for that speed.

How Well Do They Integrate with Other Tools?

Both platforms play nicely with other software, but they have their favourite dance partners.

- Talkwalker connects smoothly with business intelligence (BI) tools like Tableau and a wide range of marketing automation platforms.

- Brandwatch has deep ties into the Cision ecosystem, making it a natural fit for PR pros. It also links up well with various CRMs and data analysis tools.

Before you sign anything, make sure your non-negotiable tools—like Salesforce or HubSpot—are properly supported. Don't just tick a box; ask for a demo of the actual integration.

Our Two Cents: An "integration" can mean anything from a seamless data flow to a clunky, one-way data dump. Always ask to see it in action. You need to know if it actually supports your team's workflow or just creates another data island.

What's the Learning Curve Like?

This is where the two platforms really diverge. Talkwalker is known for its more intuitive interface, making onboarding much quicker. A marketing manager can usually get the hang of setting up queries and building useful dashboards within a couple of days.

Brandwatch, on the other hand, is a beast. It’s incredibly powerful, but that power comes with complexity. To get the most out of it, you’ll likely need a dedicated analyst who can master its sophisticated Boolean query builder. Expect a much longer and more intensive training period for your team.

Can They Track Niche Online Communities?

This is a massive differentiator, and honestly, a weak spot for both. They’ll catch conversations on massive platforms like Reddit without breaking a sweat, but they often miss the smaller, industry-specific forums where your most passionate users are having unfiltered discussions.

If your strategy relies on tapping into these deep, niche communities for raw feedback or sales leads, neither of these enterprise giants is the perfect tool for the job.

When your main goal is to monitor those hard-to-reach forums and Reddit threads for genuine user feedback or sales opportunities, a more specialised tool like ForumScout is a much better—and more affordable—fit. It’s designed from the ground up to find actionable insights in the very places enterprise tools tend to ignore. You can find your first customers for free at https://forumscout.app.