- 24 min read

Competitive Analysis Social Media: A Practical Guide to Outsmart Rivals

A social media competitive analysis is all about digging into your rivals' strategies to see where you stand, spot opportunities they've missed, and get ahead of any potential threats. It’s how you stop guessing and start making decisions based on what’s actually working in your industry, letting you sharpen your content, engagement, and growth tactics with real-world data.

Setting the Stage for a Winning Social Media Analysis

Before you even think about looking at data, you need a solid framework. A well-planned analysis isn't just a tedious task; it's a powerful strategic move. If you dive in without clear goals, you’ll quickly drown in irrelevant metrics and end up with a report that just gathers digital dust.

The whole point is to gather focused, actionable intelligence. This first step ensures every piece of data you collect actually means something and helps you avoid the classic trap of data overload. It's really about asking the right questions before you start hunting for the answers.

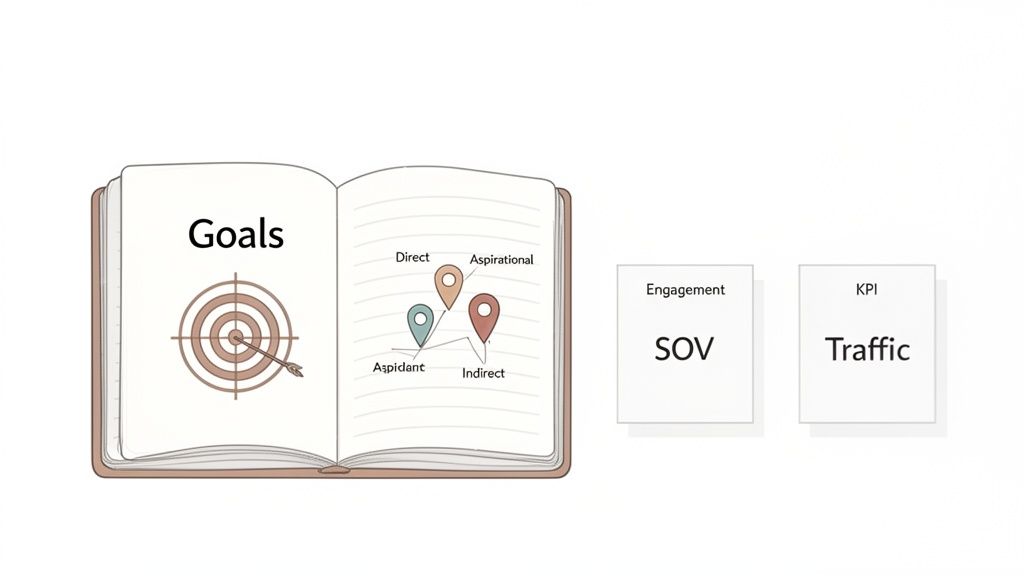

Define Clear and Measurable Goals

So, what are you actually trying to accomplish here? Vague goals like "see what competitors are doing" are a waste of time. Your objectives need to be specific, measurable, and tied directly to your bigger business goals.

Try framing your goals around tangible outcomes:

- Boost Engagement: Aim to increase your average engagement rate by 15% by figuring out which content formats are killing it for your top three competitors.

- Capture Market Share: Pinpoint two underserved topics or audience segments that your rivals are completely ignoring on their main platforms.

- Improve Content Strategy: Identify the top five performing content pillars from competitors to get inspiration for your next quarterly content calendar.

- Optimise Ad Spend: Look at your competitors' paid social activities to see where they're putting their money and why.

Setting these targets right from the start gives your analysis a clear direction and makes it way easier to measure success later. It’s the difference between wandering aimlessly and following a map.

Identify Your True Competitors

Your competitors on social media aren't always the obvious ones. You’re not just fighting against brands with similar products; you're competing for your audience's attention against anyone creating content for them.

It helps to break them down into categories:

- Direct Competitors: These are your obvious rivals, the Nikes to your Adidas. They offer similar products to the same audience.

- Indirect Competitors: They solve the same customer problem but with a different solution. Think a meal-kit delivery service versus the local supermarket.

- Aspirational Brands: These are the industry leaders you admire, even if you don't directly compete. Their strategies can be a goldmine of inspiration.

This broader perspective helps you spot emerging threats and clever tactics from outside your immediate circle. Our detailed guide on how to conduct a competitor analysis offers a more structured way to pinpoint these players.

By looking beyond direct product rivals, you uncover a richer source of strategic insights. An industry publication or a popular influencer might be your biggest content competitor, shaping audience expectations more than any other brand.

Select the Right Channels and KPIs

Don't burn yourself out trying to analyse every competitor on every single platform. Focus your energy where it actually counts—on the channels where your target audience spends their time. If your customers live on LinkedIn and Instagram, there's no point wasting hours analysing a competitor's TikTok.

Once you’ve picked your platforms, choose a handful of Key Performance Indicators (KPIs) that directly link back to your goals. These might include:

- Follower Growth Rate

- Engagement Rate (likes, comments, shares per post)

- Posting Frequency and Timing

- Content Format Mix (video vs. carousel vs. static image)

- Audience Sentiment

- Share of Voice (SOV)

To help you organise this initial planning stage, here's a simple framework.

Framework for Defining Your Analysis Scope

Use this table as a quick reference to structure your analysis plan by defining goals, identifying competitors, and selecting relevant metrics.

| Analysis Component | Key Questions to Answer | Example for a SaaS Startup |

|---|---|---|

| Business Goals | What business outcome do we want to influence? (e.g., lead generation, brand awareness) | Increase qualified leads from social media by 20%. |

| Competitors | Who are our direct, indirect, and aspirational competitors on social media? | Direct: Competitor A, B. Indirect: Industry blog. Aspirational: HubSpot. |

| Channels | Where is our target audience most active? Where are our competitors focusing their efforts? | LinkedIn and Twitter, as our audience consists of B2B professionals. |

| KPIs | Which metrics will best measure progress towards our goals? | Clicks to landing page, follower growth rate, engagement on product posts. |

This structure turns a vague idea into a concrete plan, making sure every step you take is deliberate and contributes to the final goal.

To get this off the ground effectively, you’ll need the right tools. Using some of the best social media competitor analysis tools can automate the data collection, saving you from hours of painful manual work.

In the UK, social media penetration hit an impressive 79% of the population in early 2025. That means brands are fighting for attention among nearly 55 million active users. In such a crowded space, a focused, data-driven strategy isn't just nice to have—it's essential for survival.

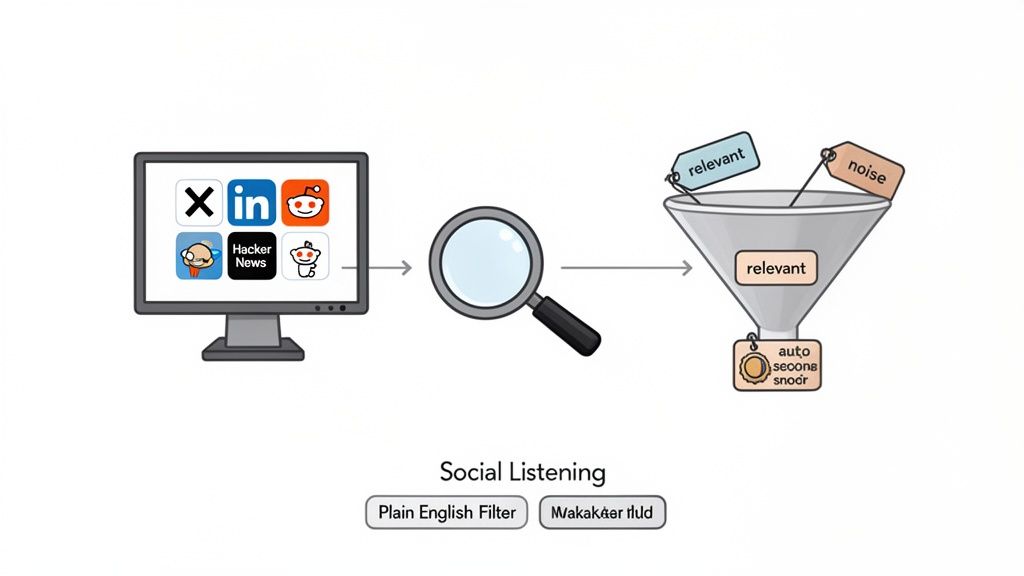

How to Gather Intelligence with Smart Social Listening

With your goals and competitors mapped out, it's time to roll up your sleeves and start gathering the raw intelligence. This is where we move from planning to action, setting up a smart monitoring system to pull in the conversations that truly matter.

Effective social listening is the engine driving any solid competitive analysis social media framework. It’s not just about collecting data; it’s about collecting the right data – the unfiltered, candid opinions that give you a genuine edge.

Moving Beyond Simple Brand Tracking

The most common mistake I see teams make is setting up alerts just for a competitor's brand name, like "@CompetitorX." That approach only gives you a tiny fraction of the picture. To get real intelligence, you need to cast a wider, more strategic net.

Think beyond the brand handle. Expand your monitoring to catch the conversations that reveal what's really going on:

- Campaign Hashtags: Are your rivals launching a new product? Track their campaign-specific hashtags (e.g.,

#RivalLaunch2025). This lets you measure the buzz—good or bad—around their biggest marketing pushes. - Product and Feature Names: Set up alerts for their key products or unique feature names. This is how you uncover what customers actually think, find common complaints, and spot pain points you can solve better.

- Key Industry Keywords: Combine competitor names with broader industry terms. For instance, a query like ("Competitor A" OR "Competitor B") AND "customer service" can unearth some serious gaps in their support that you could exploit.

This multi-layered approach ensures you're not just hearing what your competitors say about themselves, but what everyone else is saying about them too. If you want to dig deeper into setting up a robust strategy, we break it all down in our guide on what is social listening.

Tapping Into Unfiltered Conversations

Sure, X and LinkedIn are important, but the real gold is often found where conversations are raw and unfiltered. Niche communities are where people go to complain, compare products honestly, and ask for genuine recommendations without a corporate PR team watching over them.

Platforms like Reddit, Hacker News, and industry-specific forums are absolute goldmines. Here, you get a direct line into the customer’s mind, hearing their frustrations and desires in their own words.

But let's be honest, the noise can be overwhelming. That’s where modern tools make all the difference. For example, ForumScout tracks these communities hourly, using AI to cut through the chatter. Instead of you manually sifting through thousands of posts, it sends you a notification only when a genuinely relevant conversation about your competitor pops up.

The real magic of social listening isn't just collecting data; it's about efficiently finding the signal in the noise. Automated relevance scoring saves countless hours and surfaces critical insights you would have otherwise missed.

Automating the Filtering Process

Trying to manually review every mention is a recipe for burnout. As your competitive analysis grows, you'll be drowning in irrelevant data that sucks up your time and energy. This is why intelligent filtering isn't just a nice-to-have; it's essential.

Modern listening tools use AI to automatically score each mention for relevance based on rules you define. For example, in ForumScout, you can set up a plain-English filter to prioritise mentions where a user is explicitly comparing your product to a competitor's or asking for purchase advice.

This automation shifts your role from data collector to intelligence analyst. The most critical conversations are delivered right to you, so you can stop digging and start strategising. And this is more important than ever. UK Reddit usage, for instance, shot up 88% in just two years, making it a hotbed of authentic brand chatter you can't afford to ignore.

By building a smart, automated listening system, you create a powerful foundation for your entire analysis. You'll get higher-quality data with way less effort, ensuring the insights you act on are based on a truly comprehensive view of the competitive battlefield.

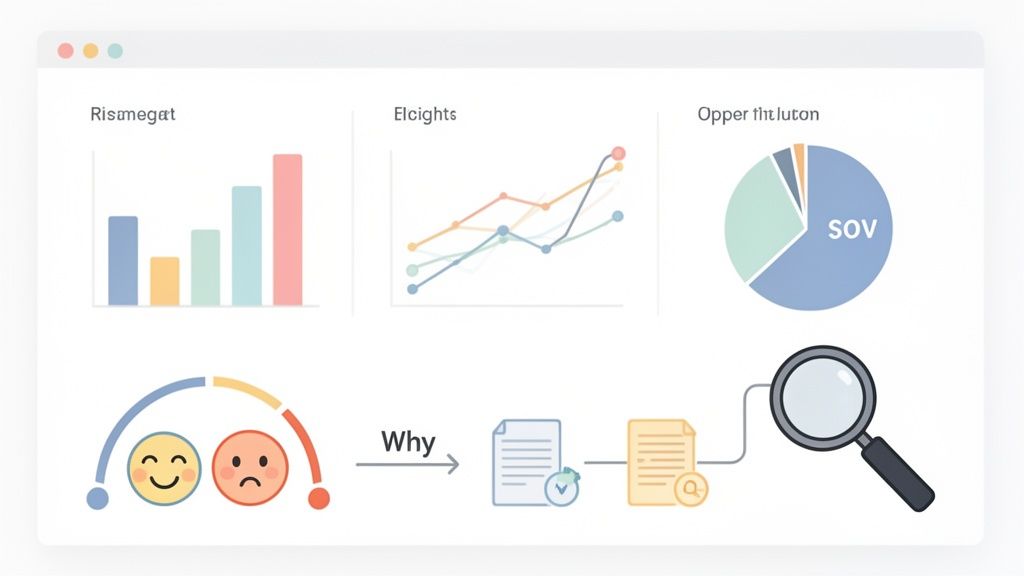

Turning Raw Data Into Actionable Competitor Insights

So you’ve gathered a mountain of competitor mentions. That's a good start, but raw data is just noise. The real magic happens when you start connecting the dots and turning that stream of chatter into a genuine strategic advantage.

This is where you move past simply counting likes and shares. You need to dig deeper to understand the story behind the numbers. Why did one competitor's campaign catch fire while another fizzled out? What are their customers complaining about over and over again? Answering these questions is how you build a strategy that actually wins.

Going Beyond Likes with Sentiment and Emotion Analysis

Standard metrics tell you what happened, but sentiment analysis tells you how people felt about it. A post might have thousands of likes, but if the comments are a dumpster fire of negativity, that high engagement is actually a massive red flag. This is a non-negotiable layer for any meaningful competitive analysis social media report.

Sentiment analysis sorts mentions into positive, negative, or neutral buckets, giving you an at-a-glance feel for brand perception. For example, you might find your main rival gets tons of positive feedback on their product quality but is constantly slammed for slow delivery. That’s not just an interesting fact; it’s a wide-open opportunity for you to exploit.

Emotion analysis pushes this even further by identifying specific feelings like joy, anger, or surprise.

- Joy: A competitor's unboxing video generates a wave of joyful comments, showing they’ve nailed their packaging and presentation.

- Anger: A stream of angry tweets about a software bug points to a clear weakness in their product or customer support.

- Surprise: A shocking new feature announcement creates a surge of surprise and buzz you can dissect and learn from.

By looking at the emotional texture of competitor mentions, you uncover the 'why' behind the metrics. This lets you pinpoint their strengths to emulate and, more importantly, their weaknesses to target with surgical precision.

Calculating Share of Voice to Benchmark Your Presence

Share of Voice (SOV) is a classic metric for a reason. It shows you how much of the conversation around your industry or specific topics is about your brand versus everyone else. Think of it as the online equivalent of market share, but for attention.

The calculation is pretty simple: divide your total brand mentions by the total mentions for all competitors you're tracking (including your own brand). Then, multiply by 100 to get your percentage.

Tracking SOV over time is where it gets really interesting. Is that new start-up suddenly eating into your conversation share? Did your latest campaign successfully drown out a rival's big launch? A rising SOV is a powerful leading indicator of growing brand awareness and market influence.

Dissecting Competitor Content Strategies

Right, let’s get into the nitty-gritty of what your competitors are actually posting. Analysing their content isn't about blindly copying them. It's about reverse-engineering what works for their audience—which is likely your audience, too—so you can do it better.

Start by grouping their best-performing content. You’re looking for patterns in a few key areas:

- Content Themes: Are they all-in on product education, user-generated content, or behind-the-scenes glimpses? Their main content pillars tell you exactly what their strategic priorities are.

- Formats and Channels: Maybe they're killing it with short-form video on TikTok but have a ghost town for a LinkedIn page. Or perhaps their Instagram carousels get amazing engagement while their single-image posts fall flat. This tells you where they’re strong and, crucially, where they might be vulnerable.

- Calls to Action (CTAs): What are they asking their audience to do? Are they pushing for sales, newsletter sign-ups, or just trying to build a community? Understanding their funnel can spark ideas for improving your own.

This kind of analysis gives you a blueprint of what resonates with your target audience. You can spot underserved topics or content formats that your brand can swoop in and own.

For instance, UK social media statistics show the ground is always shifting. While Facebook held a massive 67.92% market share between late 2024 and 2025, other platforms like X saw a 10.7% drop in ad reach, showing just how platform-specific your risks and opportunities can be. This is where tools like ForumScout's Business plan become indispensable, providing the sentiment and emotion analysis needed to find those competitor weak spots on the channels that truly matter. You can explore more about these UK digital trends to sharpen your focus.

Finding Opportunities in Your Competitors' Weaknesses

You’ve done the heavy lifting and gathered the data. Now for the fun part: turning all those charts and mentions into an actual strategy. This is where you move from just collecting data to making it work for you. Pinpointing a competitor's weaknesses isn’t about pointing fingers; it’s about finding strategic gaps in the market that your brand is perfectly positioned to fill.

Think about it: every recurring complaint, ignored customer, or lacklustre campaign from a rival is a massive, flashing sign pointing to an unmet need. Your job is to read those signals and build a plan that answers them directly. This is how you turn their vulnerabilities into your biggest strengths.

Spotting Recurring Customer Pain Points

The quickest way to find a golden opportunity is to listen to what your competitors' customers are already complaining about. These unfiltered conversations are a goldmine for product improvements, fresh content ideas, and ways to make your service better.

Start looking for patterns in all those negative mentions. Are people constantly getting frustrated with things like:

- Poor Customer Service? A constant stream of comments like, "Waited three days for a reply," is a huge opening. You can immediately highlight your brand's fast, responsive support and win them over.

- Missing Features? When you see users asking, "Why can't your app do X?" they’re literally handing you a feature roadmap on a silver platter. That's a clear demand you can meet.

- Confusing Pricing? If their pricing page is a common source of frustration, you have a massive opportunity to win over customers with clear, simple, and transparent pricing tiers.

- Product Bugs or Flaws? A consistent thread of complaints about a specific glitch is your chance to position your product as the stable, more reliable alternative.

By methodically grouping these complaints, you shift from just noticing random comments to building a structured list of proven market needs. It’s a data-driven approach that ensures your next move is based on real demand, not just a hunch.

The real beauty of social listening is that your rivals' customers will tell you exactly what they want. All you have to do is be the one who actually listens and acts on it.

Identifying Underserved Audience Segments

Competitors, especially the big players, tend to focus all their energy on their main, most profitable audience. In doing so, they often leave valuable niche segments completely underserved. Your social media analysis is perfect for spotting who these overlooked groups are and what they really care about.

For instance, a major software company might be laser-focused on enterprise clients, completely ignoring the unique needs of startups or freelancers. You might notice these smaller businesses asking specific questions on forums or Reddit that the big brands never bother to answer. That’s your cue. You can create content, tutorials, or even product features just for them.

Keep an eye out for questions your competitors ignore or conversations they aren’t a part of. These gaps often shine a spotlight on an entire user group whose needs aren't being met, giving you a clear shot at becoming their go-to brand.

Adapting and Improving on Competitor Successes

Finding opportunities isn't just about exploiting what your competitors do wrong. It's also about learning from what they do right—and then figuring out how to do it even better. Reverse-engineering their successful tactics can give you a proven blueprint for your own campaigns, saving you a ton of time and guesswork.

If a rival's educational video series on YouTube consistently gets high engagement, don't just sit back and admire it. Dig in. Analyse its structure, tone, and the topics they cover. Then, instead of just copying it, find a way to improve upon it. Could you make your videos more in-depth? Maybe feature more expert guests, or present the information with slicker visuals?

Here’s a simple framework to follow:

- Identify a successful tactic: Find a specific content format or campaign that is clearly killing it with their audience.

- Deconstruct its elements: What’s the secret sauce? Is it their storytelling, their humour, the visual style, or a really compelling call to action?

- Find the improvement angle: Ask yourself, "What if we did this?" Can you add a unique perspective, use a different platform to reach a new audience, or target a more specific niche within that same topic?

This "emulate and elevate" approach lets you build on proven concepts while still making your brand stand out. It’s a smart way to lower risk and get your content strategy on the fast track by learning from what the market already loves.

A SWOT (Strengths, Weaknesses, Opportunities, Threats) analysis is a classic framework for a reason—it works. It provides a structured way to map out your findings and turn them into a clear, actionable plan.

Here’s how you can categorise the insights you've gathered from your social media deep dive:

Competitor SWOT Analysis Matrix

| Category | Description | Example Finding |

|---|---|---|

| Strengths | What your competitor does exceptionally well. | "Their YouTube tutorial series receives 50% more engagement than any other content, indicating strong educational authority." |

| Weaknesses | Areas where your competitor is consistently failing or falling short. | "Recurring complaints about their 3-day support response time are driving customers away." |

| Opportunities | Gaps in the market or competitor weaknesses your brand can exploit. | "Freelancers and startups are an underserved segment asking for features our product already has." |

| Threats | External factors or competitor strengths that could negatively impact your brand. | "A major competitor just launched a partnership with a key influencer in our niche, potentially capturing market share." |

By laying everything out in this matrix, you create a strategic snapshot. It visually connects your competitor's shortcomings directly to your brand's opportunities, making it much easier to decide on your next move.

Putting Your Findings Into Action and Proving Their Impact

Collecting competitive insights is one thing, but actually weaving them into your growth engine is another game entirely. A beautifully detailed report gathering dust in a shared drive is a massive wasted opportunity. The real magic happens in this final step: operationalising your findings so they drive daily decisions and show real, measurable value.

This is where you connect the dots between analysis and action. It’s all about creating reports that people actually want to read, building slick automated workflows to snag real-time opportunities, and setting a review rhythm that keeps your strategy sharp.

Building Reports That Inspire Action

Let's be honest, your stakeholders—whether it's the marketing director or the C-suite—don't have time to wade through spreadsheets of raw data. They need a clear, compelling story that gets straight to the point: what did we learn, and what are we going to do about it?

A great report doesn't just dump data; it tells a narrative. Try structuring your findings around a few key themes you’ve uncovered, like a competitor's glaring customer service weakness or their runaway success with a certain content format.

To make your report hit home:

- Lead with the ‘So What?’: Kick things off with a punchy executive summary. Highlight the top three takeaways and the actions you recommend right away.

- Visualise Everything: Use charts and graphs to illustrate trends in sentiment, engagement, or Share of Voice (SOV). A good visual is far more persuasive than a wall of text.

- Give Clear Next Steps: For every insight, propose a concrete, actionable recommendation. Instead of a vague "we should use more video," try "we will pilot a three-part educational video series on Topic X next month."

The whole point of a competitive analysis report isn't just to inform, but to persuade. Frame every finding as a data-backed opportunity and tie it directly to a business goal like lead generation or improving brand health.

If you want to get more granular with metrics like SOV, our guide on share of voice measurement techniques can give your reports an extra edge.

Automating Intelligence to Act Faster

The world of social media moves incredibly fast. A competitor's PR disaster or a new campaign that suddenly goes viral can happen overnight. If you're only looking at the data once a month, you're constantly playing catch-up. This is exactly why automated workflows are a game-changer for any serious competitive analysis social media strategy.

Tools like ForumScout can be plugged into your existing tech stack to create a real-time alert system. By integrating with platforms like Zapier or Make, you can build seriously powerful, custom automations without writing a single line of code.

Here's what that can look like in practice:

- Crisis Monitoring: Instantly send a Slack notification to your comms team the moment a competitor's negative sentiment spikes above a certain threshold.

- Lead Generation: When ForumScout finds a Reddit thread where someone is comparing your product to a rival's, automatically create a new row in a Google Sheet for the sales team to follow up.

- Content Inspiration: Trigger an alert whenever a competitor's post on a specific topic gets unusually high engagement, flagging it as a potential trend for you to jump on.

These automated workflows transform your analysis from a passive, backward-looking chore into a proactive, real-time intelligence function. Once you've analysed what your competitors are doing, you can take what you've learned and explore an ultimate guide to Facebook retargeting to really maximise your campaign's impact.

Establishing a Cadence for Continuous Improvement

A one-off analysis gives you a snapshot in time, but a continuous process creates a real, sustainable advantage. The trick is to establish a realistic rhythm for running and reviewing your competitive intelligence. There’s no one-size-fits-all model here; it all depends on how fast your industry moves and your team's bandwidth.

Here’s a practical cadence you can start with:

- Weekly Pulse Checks (15-30 minutes): A quick scan of your automated alerts and dashboards. Look for any big spikes in mentions, shifts in sentiment, or emerging viral content from competitors.

- Monthly Deep Dives (1-2 hours): This is where you zoom out and analyse trends over the past month. Update your core metrics (SOV, engagement), pinpoint top-performing content from rivals, and tweak your own content calendar based on what you find.

- Quarterly Strategic Reviews (Half-day): A bigger-picture session with key stakeholders. It's the perfect time to re-evaluate your list of competitors, dust off your SWOT analysis, and set strategic priorities for the coming quarter based on everything you’ve learned.

By embedding this rhythm into your operations, competitive analysis stops being a "project" and becomes a core part of how you plan, execute, and adapt. This continuous loop of learning and acting is what separates brands that simply react from those that consistently lead the pack.

Frequently Asked Questions

Diving into social media competitive analysis can feel a bit overwhelming at first. I get it. To help clear things up, I've put together answers to some of the most common questions we hear from teams just starting out.

What Are the Best Metrics for a Social Media Competitor Analysis?

It's tempting to fixate on follower counts, but that's just a vanity metric. It tells you very little about what's actually working. For a real sense of a competitor's performance, you need to look deeper at the metrics that show genuine audience connection.

Here are the ones that actually matter:

- Engagement Rate: This is your best indicator of how well content is landing. It measures likes, comments, and shares relative to follower size, showing you who has a truly active community.

- Share of Voice (SOV): This tells you how much of the conversation in your niche is about your brand versus your rivals. It’s a direct measure of market presence.

- Sentiment Trends: Are the mentions positive, negative, or just neutral? Tracking this helps you understand brand perception and can be an early warning system for a PR crisis.

- Follower Growth Rate: Forget the total number; the speed at which a competitor is gaining followers reveals their current momentum and brand appeal.

These metrics give you a much clearer picture of who’s winning hearts and minds, not just collecting followers.

How Often Should I Conduct a Competitor Analysis?

A one-off report is a great starting point, but the real magic happens when you make analysis a consistent habit. The right cadence depends on how fast your industry moves, but for most, a structured rhythm is the way to go.

A single analysis provides a snapshot; a continuous process builds a sustainable advantage. Treat it as an operating rhythm, not a one-time project.

Here’s a schedule that works for most teams we’ve seen:

- Weekly Pulse Checks: Just 15-20 minutes is all you need. Scan your automated alerts for any sudden spikes in competitor mentions or major shifts in sentiment. It’s a quick health check.

- Monthly Deep Dives: Set aside an hour or two to dig into the trends. Update your core metrics, see what content performed best for your rivals, and spot any patterns.

- Quarterly Strategic Reviews: This is where you zoom out. Do a full review to update your SWOT analysis and use the insights to shape your priorities for the next quarter.

This approach keeps you agile and ensures your strategy is always based on fresh intelligence, not outdated assumptions.

What Tools Make Competitive Analysis Easier?

Trying to manually track every competitor across multiple platforms is a recipe for burnout and missed insights. You absolutely need the right tools to automate the heavy lifting and surface the stuff that actually matters.

This is where modern social listening platforms come in. They’re built for this exact task. They can automatically track mentions, analyse sentiment, and benchmark performance metrics, saving your team countless hours of tedious work. A good tool will give you dashboards that visualise competitor data, making it incredibly simple to spot trends and share your findings with the rest of the team.

Ready to stop guessing and start winning with data-driven insights? ForumScout gives you the power to monitor competitors in real-time, analyse audience sentiment, and uncover strategic opportunities they've missed. Start your free 7-day trial and see what your rivals are really up to at https://forumscout.app.