- 25 min read

8 Competitor Analysis Examples You Need To Know in 2026

In today's fast-moving market, staying ahead of the competition isn't just about knowing who they are. It’s about understanding what their customers are saying about them, right now, in real-time. Traditional competitive analysis often misses the unfiltered conversations happening on social media, forums, and review sites. These discussions are a goldmine of strategic intelligence, revealing competitor weaknesses, unmet customer needs, and emerging market trends long before they appear in quarterly reports.

This guide moves beyond theory to provide practical, step-by-step frameworks. We'll explore a powerful competitor analysis example for different scenarios, showing you how to turn raw customer chatter into a strategic asset. From SWOT analysis and perceptual mapping to detailed customer pain point investigations, you will learn how to gather and interpret real-world data. Each example is designed to be actionable, helping you pinpoint opportunities your rivals have overlooked.

1. SWOT Analysis Framework

The SWOT analysis framework is a cornerstone of strategic planning, offering a structured method to evaluate a competitor's Strengths, Weaknesses, Opportunities, and Threats. While traditionally used for internal assessment, it is a powerful tool for organising competitive intelligence. In the context of social listening, it helps you categorise real-time customer feedback from platforms like forums, social media, and review sites, transforming raw data into a clear competitive landscape.

This method involves systematically monitoring what people praise about your competitors (their strengths), what they complain about (their weaknesses), unmet customer needs that represent market gaps (opportunities), and emerging negative sentiment or new rivals (threats).

How to Apply It: A Mini Case Study

A B2B SaaS company wanted to refine its product roadmap and marketing messages. Using a social listening tool like ForumScout, they set up alerts to monitor mentions of their top three competitors across LinkedIn, Reddit (specifically in r/saas), and industry-specific forums.

- Strengths: They discovered customers consistently praised a competitor's user interface (UI) and integration capabilities. This confirmed the competitor's market position as the "easy-to-use" solution.

- Weaknesses: Sentiment analysis revealed a high volume of negative mentions regarding the same competitor's customer support response times and inflexible pricing tiers.

- Opportunities: Numerous discussions highlighted a need for advanced analytics features that no competitor was currently offering effectively. This became a priority for their own development team.

- Threats: They noticed growing positive sentiment around a new, lower-cost market entrant, identifying a potential pricing threat before it became a major issue.

Strategic Insight: By organising raw social listening data into a SWOT framework, the SaaS company didn't just see what people were saying; they understood the strategic implications of that sentiment. This competitor analysis example shows how to turn customer complaints into a competitive advantage.

Actionable Takeaways & Tips

To replicate this process, you can:

- Validate Weaknesses with Sentiment Analysis: Use sentiment scores in your social listening tool to quickly confirm if a perceived weakness is a widespread issue or just an isolated complaint.

- Create Topic-Specific Alerts: Set up keyword alerts for terms like "[Competitor Name] + pricing," "[Competitor Name] + support," or "[Competitor Name] + feature request" to automatically categorise mentions.

- Combine with Share of Voice (SoV): Track your SoV against competitors. If a competitor's SoV is high but sentiment around their weaknesses is also high, it presents a clear opportunity to target their dissatisfied customers.

2. Porter's Five Forces Analysis

Porter's Five Forces is a strategic framework for analysing an industry's competitive intensity and attractiveness. It evaluates five key forces: the threat of new entrants, the bargaining power of suppliers, the bargaining power of buyers, the threat of substitute products or services, and the existing competitive rivalry. By integrating social listening, businesses can move beyond theoretical analysis and tap into real-time discussions that reveal how these forces are perceived by customers and industry insiders on platforms like Hacker News, Reddit, and LinkedIn.

This method involves monitoring online conversations to gauge the strength of each force. For instance, you can track developer communities for mentions of new tools that could disrupt your market (new entrants) or follow customer service forums to see how easily customers can switch to an alternative solution (threat of substitutes).

How to Apply It: A Mini Case Study

A project management SaaS company wanted to assess its long-term market position. They used a forum monitoring tool to track discussions across several key communities, assigning each of the five forces to a separate monitoring stream.

- Threat of New Entrants: They monitored Hacker News and Product Hunt for announcements of new project management tools. They noticed a surge in "open-source alternative to [Competitor Name]" discussions, signalling a low barrier to entry for new, developer-focused tools.

- Bargaining Power of Buyers: In the r/projectmanagement subreddit, they found numerous threads where users debated demanding discounts and month-to-month contracts from major providers, indicating that buyers felt empowered to negotiate terms.

- Threat of Substitutes: On LinkedIn, they tracked posts comparing their software not just to direct competitors, but also to "good enough" substitutes like advanced spreadsheets (Google Sheets, Airtable) and collaborative documents, revealing a broader competitive landscape.

- Competitive Rivalry: They monitored brand-versus-brand discussions, observing that competitors were increasingly competing on feature velocity rather than price, leading to a crowded and confusing feature race.

Strategic Insight: This competitor analysis example demonstrates how to use social listening to map out the entire industry structure. The company realised their biggest threat wasn't just another SaaS tool, but the growing power of buyers and the viability of simple substitutes.

Actionable Takeaways & Tips

To replicate this process, you can:

- Set Up Force-Specific Streams: Create separate alerts in your monitoring tool for each of Porter's Five Forces (e.g., alerts for "new alternative," "switching from [Competitor]," "negotiating price").

- Monitor Industry Trend Discussions: Track broader keywords like "future of project management" or "best tools for agile teams" to identify early shifts in competitive forces before they centre on specific brands.

- Analyse Sentiment Around Substitutes: Use sentiment analysis to gauge how positively users speak about substitute products. A rising positive sentiment can signal an increasing threat level.

- Track Share of Voice for Threats: Monitor the share of voice for new entrants and key substitute products to quantify their growing presence in the market conversation.

3. Positioning Map (Perceptual Mapping)

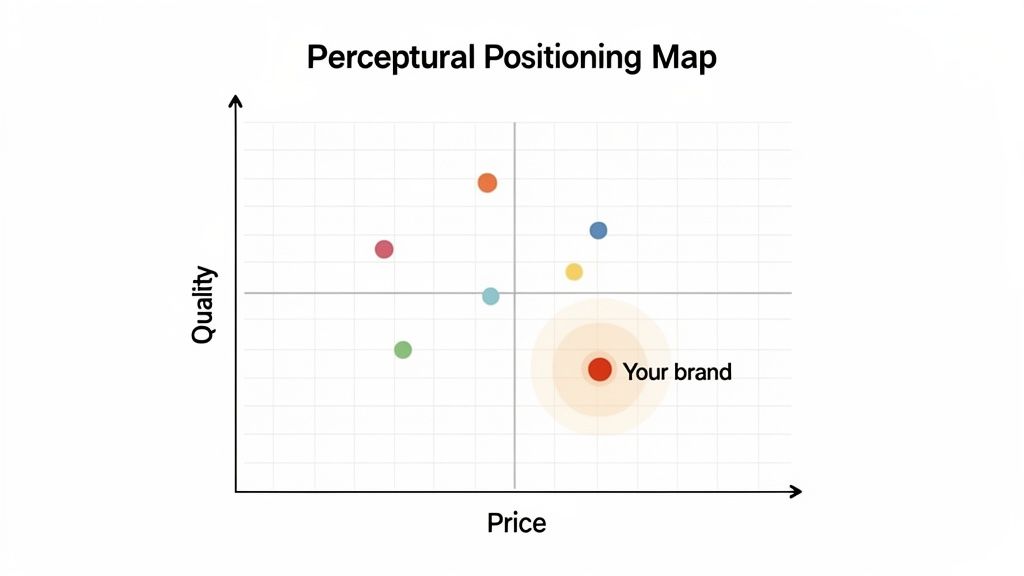

A positioning map, or perceptual map, is a visual competitor analysis technique that plots brands on two axes representing key attributes that customers value. This framework helps you understand not just where competitors are, but where they are perceived to be in the minds of your audience. By using social listening to gather this perception data, you can uncover strategic gaps in the market and opportunities for powerful differentiation.

This method involves defining two critical dimensions, such as "Price vs. Quality" or "Ease of Use vs. Feature Depth," and then mapping competitors based on customer conversations found on forums, social media, and review sites. It visually answers the question: "Is there an uncontested space in the market we can own?"

How to Apply It: A Mini Case Study

An email marketing platform wanted to carve out a unique position in a crowded market. They used ForumScout to analyse YouTube reviews, LinkedIn discussions, and marketing-focused subreddits to understand how customers perceived them and their rivals on the dimensions of 'Affordability' vs. 'Advanced Automation'.

- Axis 1 (Affordability): They tracked mentions of pricing, plans, and value-for-money. Sentiment analysis quickly showed which tools were consistently labelled "expensive" or a "great deal."

- Axis 2 (Advanced Automation): They monitored conversations around features like "segmentation," "lead scoring," and "complex workflows." This revealed which platforms were seen as powerful for enterprise users versus those viewed as simple and basic.

- Mapping the Data: They discovered the market was saturated with low-cost, simple tools and high-cost, complex platforms. A significant gap existed for a tool perceived as having advanced automation capabilities at an affordable price point.

- Strategic Action: The company repositioned its messaging to highlight its sophisticated automation features while running a campaign focused on its competitive pricing, directly targeting this identified market gap.

Strategic Insight: The positioning map transformed raw customer opinions into a visual battleground. This competitor analysis example shows that the key isn't just knowing your features, but understanding how the market perceives your value proposition relative to everyone else.

Actionable Takeaways & Tips

To replicate this process, you can:

- Identify Key Dimensions from Conversations: Don't guess which attributes matter. Use your social listening tool to identify the features or benefits customers mention most frequently when comparing solutions in your category.

- Monitor Industry-Specific Forums: Find the niche communities where your ideal customers discuss problems. For a project management tool, this might be r/projectmanagement; for a CRM, it could be a dedicated Salesforce or HubSpot user forum.

- Track Positioning Over Time: Your market position isn't static. Use historical data to create maps on a quarterly basis, tracking how your brand's perception changes in response to marketing campaigns or product updates.

4. Benchmarking Analysis

Benchmarking analysis is a systematic process of measuring your company's performance metrics against those of key competitors and industry leaders. While traditionally reliant on internal data, applying social listening supercharges this method. It allows you to benchmark against customer perception of performance across metrics like support response times, feature completeness, and pricing fairness, using real-world conversations from forums and social media.

This approach involves monitoring specific keyword clusters related to performance indicators. By tracking how often customers praise or complain about a competitor's shipping speed or software uptime, you can build an external performance baseline to measure your own operations against.

How to Apply It: A Mini Case Study

An e-commerce brand specialising in electronics wanted to benchmark its delivery and customer service performance against two larger rivals. They used ForumScout to monitor mentions related to shipping and support on Twitter, Trustpilot, and relevant Reddit communities like r/techsupport.

- Customer Support Speed: They tracked phrases like "[Competitor A] support response" and "[Competitor B] long wait time". They found Competitor A was consistently praised for its rapid live chat resolution, setting a clear industry benchmark.

- Shipping & Delivery: By monitoring keywords such as "delivery time" and "arrived early" alongside competitor names, they discovered customers frequently complained about Competitor B's delayed shipments, despite their low prices. This highlighted a vulnerability.

- Pricing Satisfaction: The brand analysed discussions on deal forums where users compared product prices. Sentiment analysis showed that while their own prices were slightly higher, positive mentions of their "excellent warranty service" often justified the cost, revealing a key value proposition.

Strategic Insight: This competitor analysis example demonstrates that benchmarking isn't just about internal KPIs. By analysing public perception, the e-commerce brand identified that customers valued reliable delivery over the lowest price, allowing them to confidently position themselves as the premium, dependable option.

Actionable Takeaways & Tips

To replicate this process, you can:

- Create Metric-Specific Searches: Set up alerts for keywords like "[Competitor] + uptime," "[Competitor] + customer service," or "[Competitor] + shipping speed" to isolate relevant conversations.

- Use Emotion Analysis: Gauge customer satisfaction levels around each benchmark. High negative emotion tied to a competitor’s "pricing" is a clear signal of an opportunity. To delve deeper, you can learn more about how to benchmark with competitors using qualitative data.

- Track Performance Over Time: Set up recurring reports to monitor these benchmarks quarterly. This helps you spot if a competitor is improving their service or if a new issue is emerging.

5. Share-of-Voice (SOV) Analysis

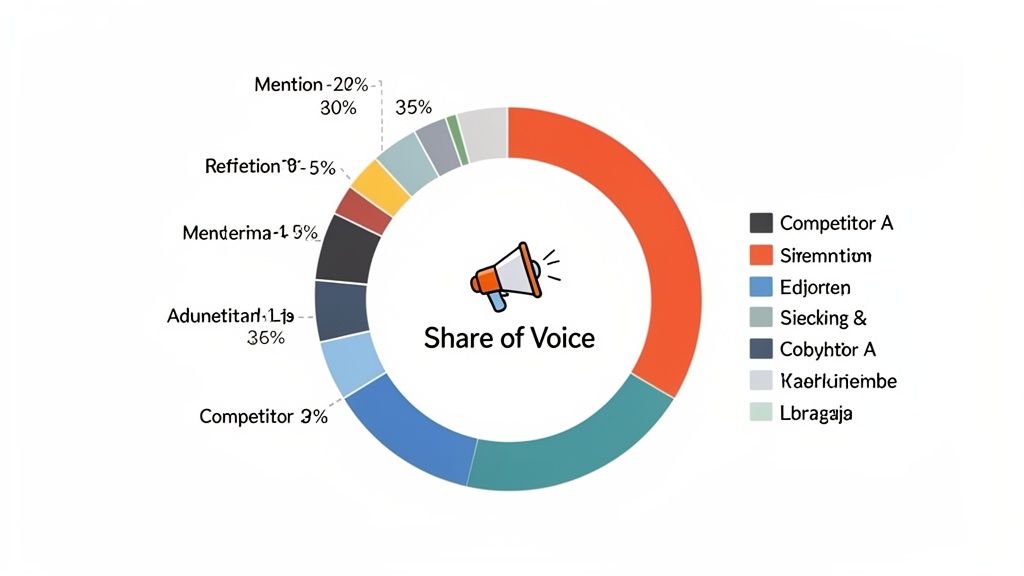

Share-of-Voice (SOV) analysis is a classic competitive intelligence metric that measures your brand's visibility against your competitors. Traditionally used in advertising, it has been revitalised for the digital age, measuring the volume of online conversations about your brand versus others. In the context of social listening, it quantifies your brand’s presence on platforms like forums, social media, and news sites, offering a clear gauge of market mindshare.

This method involves tracking brand mentions for yourself and key competitors over a set period. By calculating the percentage of total mentions each brand commands, you can identify who is dominating the conversation, who is an emerging threat, and whether your marketing efforts are successfully increasing your presence.

How to Apply It: A Mini Case Study

A new project management tool wanted to understand its position in a crowded market dominated by two established leaders. They used ForumScout to monitor their brand mentions alongside their top two competitors and a notable up-and-coming rival across Reddit, specialised SaaS review forums, and Twitter.

- Baseline Measurement: Initially, they found their SOV was just 4%, while the market leaders held 45% and 38% respectively. The other emerging rival had 13%. This provided a clear, quantitative baseline of their market standing.

- Campaign Impact: After launching a targeted content marketing campaign and engaging in relevant subreddits, they tracked their SOV weekly. Over six weeks, their SOV climbed to 9%, while the second-largest competitor’s dropped to 34%.

- Emerging Threat Detection: The analysis also revealed that the other emerging rival's SOV was growing at a faster rate, signalling that they were a more immediate competitive threat than initially realised.

- Platform-Specific Insights: They discovered that while one leader dominated Twitter conversations, the other had a stronger presence in technical forums, allowing them to tailor their engagement strategy for each platform.

Strategic Insight: SOV analysis provided a direct feedback loop on their marketing effectiveness. They didn't just guess if their campaign was working; they saw its impact on their mindshare in near real-time, which is a powerful leading indicator for future market share shifts.

Actionable Takeaways & Tips

To replicate this process, you can:

- Automate Tracking: Set up an automated dashboard in your social listening tool to track SOV trends for your brand and your top 3-5 competitors. This saves time and ensures consistent monitoring.

- Combine with Sentiment: A high SOV is only valuable if the sentiment is positive. Layer sentiment analysis over your SOV data to ensure an increase in mentions reflects positive brand perception, not a viral complaint. For a deeper dive, you can learn more about share of voice measurement and its nuances.

- Segment by Platform: Break down your SOV by channel (e.g., Reddit vs. LinkedIn vs. Twitter). This reveals where each competitor has the strongest community and where you have opportunities to grow your presence.

6. Customer Pain Point & Feature Gap Analysis

This qualitative competitor analysis method focuses on identifying unmet customer needs by systematically analysing complaints, feature requests, and pain points mentioned in online discussions about your competitors. It moves beyond high-level sentiment to uncover specific, actionable opportunities. By monitoring platforms like Reddit, industry forums, and social media, you can pinpoint exactly where competitors are failing to meet customer expectations.

This approach is rooted in the "Jobs to be Done" framework, which posits that customers "hire" products to solve specific problems. When a competitor's product fails to do the job effectively, customers voice their frustrations online. These discussions are a goldmine for identifying feature gaps and powerful messaging angles that position your product as the superior solution.

How to Apply It: A Mini Case Study

A project management software company noticed its primary competitor was dominant but received mixed reviews. They wanted to find a specific weakness to exploit in their marketing. Using a community monitoring tool, they set up alerts to track negative mentions of their competitor, specifically looking for phrases like "frustrated with," "wish it had," and "missing feature" on Reddit (r/projectmanagement) and specialised SaaS review forums.

- Pain Point Identification: They quickly discovered a recurring theme: users found the competitor's interface powerful but overly complex and slow for daily task management. The sentiment was consistently one of frustration, not just mild inconvenience.

- Feature Gap Analysis: Users frequently mentioned the lack of a simple, "at-a-glance" dashboard for team-wide progress. They were forced to build convoluted workarounds, a clear sign of an unmet need.

- Opportunity: The company realised their own product's core strength was its clean, intuitive dashboard. This wasn't just a feature; it was the direct solution to their competitor's most significant user pain point.

- Action Taken: They launched a targeted ad campaign with the headline: "Tired of Complex Project Tools? Get Your Team's Progress at a Glance." The campaign directly addressed the identified pain point and highlighted their differentiating feature.

Strategic Insight: This competitor analysis example demonstrates how to find a precise market opening. By focusing on specific pain points instead of general sentiment, the company uncovered a high-value differentiator and crafted a marketing message that resonated deeply with their rival's dissatisfied user base.

Actionable Takeaways & Tips

To replicate this process, you can:

- Filter for Intent: Use AI-powered search filters to specifically hunt for phrases indicating desire or frustration, such as "I wish [Competitor] could," "annoying that," or "the biggest problem is."

- Prioritise with Emotion Analysis: Leverage emotion analysis to distinguish between minor annoyances and intense frustrations. High-frustration pain points represent the most urgent and valuable opportunities.

- Track Trends Over Time: Monitor the volume of specific pain point mentions over several months. A rising trend indicates a growing market need that you can be the first to solve.

7. Competitive Win/Loss Analysis

Competitive win/loss analysis is a systematic process for understanding why your business wins or loses deals against specific rivals. It moves beyond internal sales reports by tapping into authentic customer conversations on review sites, forums, and social media. Using a social listening tool allows you to uncover the precise features, pricing points, or messaging that tipped the scales in a competitor's favour, connecting intelligence directly to revenue outcomes.

This method involves monitoring for phrases that signal a purchase decision, such as customers explaining why they "switched to [Competitor]" or found a specific feature "better than [Your Brand]". By aggregating these public conversations, you can build a data-driven picture of your competitive standing in the final stages of the buyer journey.

How to Apply It: A Mini Case Study

A growing fintech startup wanted to understand why it was losing potential users to a larger, more established competitor, despite having a more modern interface. They used a social listening tool to monitor mentions of both their brand and their competitor's on Twitter, Reddit (specifically r/personalfinance and r/fintech), and Trustpilot.

- Loss Reasons Identified: They quickly discovered a recurring theme. While users loved their app's design, many expressed anxiety about the startup's smaller size and perceived lack of security credentials. Posts frequently mentioned choosing the competitor "for peace of mind" or because it was a "more established and trusted name."

- Win Reasons Analysed: Conversely, mentions from customers who chose their platform consistently praised its transparent and lower fee structure. The key winning message was clearly tied to cost-effectiveness.

- Strategic Pivot: The team realised their marketing focused too heavily on UI/UX and not enough on building trust. They updated their website and ad campaigns to prominently feature security certifications, insurance details, and customer testimonials that explicitly mentioned "trust" and "reliability."

Strategic Insight: This competitor analysis example demonstrates that the deciding factor in a purchase isn't always the most marketed feature. By listening to win/loss discussions, the fintech company identified a critical messaging gap between what they were promoting (design) and what customers truly valued (trust and security).

Actionable Takeaways & Tips

To implement this analysis, you can:

- Set Up Win/Loss Keyword Alerts: Create specific monitoring streams for phrases like "chose [Competitor] because," "switched from [Your Brand] to," and "[Competitor] vs [Your Brand]".

- Segment by Customer Type: Analyse win/loss reasons for different customer segments (e.g., enterprise vs SMB). You may find that different groups prioritise different value propositions.

- Analyse Emotional Drivers: Use sentiment analysis to gauge the emotional intensity behind win/loss reasons. Are customers angry about your pricing or just indifferent? Are they enthusiastic about a competitor's feature? This adds crucial context.

8. Influencer & Advocate Monitoring for Competitive Intelligence

This competitor analysis example focuses on tracking what key opinion leaders, industry experts, and brand advocates say about your rivals. Instead of just monitoring general public sentiment, this method hones in on the high-impact voices that shape market perception on platforms like LinkedIn, X (formerly Twitter), YouTube, and industry forums. By understanding how thought leaders frame your competitors, you gain powerful insights into their perceived strengths and strategic narratives.

This approach involves identifying and monitoring the individuals and organisations whose opinions carry significant weight within your industry. Tracking their commentary provides an early warning system for shifts in market positioning and reveals how competitor messaging is being interpreted and amplified by trusted third parties.

How to Apply It: A Mini Case Study

A DevOps platform provider wanted to understand how its primary competitor was perceived by prominent technical influencers. They used a social listening tool to create a curated list of 50 key DevOps engineers, bloggers, and conference speakers to monitor across X and specialised tech forums.

- Influencer Praise: They noticed several top influencers consistently praised a competitor’s new automation feature, often sharing code snippets and success stories. This highlighted the feature's role as a key competitive differentiator.

- Advocate Concerns: Analysis of comments on influencer posts revealed that while the core feature was praised, the influencer's followers frequently complained about its steep learning curve and poor documentation.

- Analyst Commentary: Monitoring LinkedIn discussions from analysts at firms like Gartner showed a growing narrative around the competitor's suitability for enterprise-scale deployments, a market segment the company wanted to penetrate.

- Emerging Narratives: They identified a pattern where influencers began comparing the competitor’s tool to an emerging open-source alternative, signalling a potential long-term threat to its market position.

Strategic Insight: By isolating influencer and advocate conversations, the DevOps company realised the competitor's market strength was heavily tied to a single, highly-praised feature, but its user experience was a significant vulnerability. This insight guided their own content marketing, which focused on their platform's ease of use and comprehensive support.

Actionable Takeaways & Tips

To replicate this process, you can:

- Segment Your Monitoring: Create separate alerts or dashboards for influencers versus the general audience. This allows you to measure thought leadership perception distinctly from overall brand sentiment.

- Track Audience Reactions: Don't just monitor what the influencer says; analyse the sentiment and topics in the comments on their posts. This reveals how their opinions influence their followers' perceptions.

- Identify Your Own Advocates: Use the principles of social listening to find influencers who are neutral or who already favour your solution. Building relationships with them can amplify your competitive differentiation and counter rival narratives.

- Analyse Emotional Cues: Look for shifts in the language influencers use when discussing competitors. A change from "innovative" to "reliable" or "complex" can signal a significant change in market perception before it becomes widespread.

Competitor Analysis: 8 Methods Compared

| Method | Implementation Complexity 🔄 | Resource Requirements ⚡ | Expected Outcomes 📊 | Ideal Use Cases 💡 | Key Advantages ⭐ |

|---|---|---|---|---|---|

| SWOT Analysis Framework | Low — simple four-quadrant categorization 🔄 | Low — basic social listening + periodic updates ⚡ | High-level positioning and quick insights 📊 | Strategic planning, competitor snapshots 💡 | Easy to adopt; fast strategic clarity ⭐ |

| Porter's Five Forces Analysis | High — multi-factor industry assessment 🔄 | Moderate–High — cross-force data & expertise ⚡ | Deep structural market and threat insights 📊 | Market entry analysis, long-term strategy 💡 | Comprehensive view of competitive intensity ⭐ |

| Positioning Map (Perceptual Mapping) | Moderate — requires axis selection & plotting 🔄 | Moderate — perception data and visualization tools ⚡ | Visualized gaps and differentiation opportunities 📊 | Product positioning, differentiation, messaging 💡 | Clear, communicable view of market space ⭐ |

| Benchmarking Analysis | Moderate — metric selection and comparison 🔄 | Moderate–High — continuous metric tracking ⚡ | Concrete performance gaps and target metrics 📊 | Operations improvement, KPI-driven teams 💡 | Data-driven, measurable improvement targets ⭐ |

| Share-of-Voice (SOV) Analysis | Low — volume-based tracking 🔄 | Low — mention volume monitoring and dashboards ⚡ | Early indicator of momentum and mindshare shifts 📊 | Marketing effectiveness, competitor traction monitoring 💡 | Simple metric with early-warning value ⭐ |

| Customer Pain Point & Feature Gap Analysis | Moderate — qualitative synthesis required 🔄 | Moderate — deep community monitoring & analysis ⚡ | Product opportunities and prioritized feature needs 📊 | Product development, messaging refinement 💡 | Directly informs product-market fit and priorities ⭐ |

| Competitive Win/Loss Analysis | High — correlates deals with competitive factors 🔄 | High — sales integration + social monitoring ⚡ | Revenue-linked reasons for wins and losses 📊 | Sales enablement, pricing and messaging strategy 💡 | Actionable, tied directly to revenue outcomes ⭐ |

| Influencer & Advocate Monitoring | Moderate — identification and ongoing tracking 🔄 | Moderate — influencer tracking + relationship work ⚡ | Early perception shifts via key opinion leaders 📊 | PR, thought leadership, counter-messaging campaigns 💡 | Amplifies intelligence through trusted voices; early signals ⭐ |

From Analysis to Action: Your Next Move

We have journeyed through a comprehensive collection of competitor analysis example frameworks, from the foundational SWOT and Porter’s Five Forces to the nuanced insights of Share-of-Voice and Customer Pain Point analysis. Each method, when viewed through the modern lens of social listening, offers a powerful way to transform raw data from online conversations into a strategic advantage. The examples provided are not just theoretical exercises; they are practical blueprints designed to be adapted and implemented within your own business, regardless of your industry or size.

The central theme weaving through each example is the shift from static, periodic reviews to a dynamic, continuous process. In today’s fast-paced digital landscape, the idea of an annual competitor audit is obsolete. Market sentiment can shift overnight, a new feature from a rival can capture the public’s imagination in a weekend, and customer pain points can surface and fester on forums long before they appear in traditional market research reports.

Key Takeaways from Our Competitor Analysis Examples

To truly embed these concepts into your strategy, let's crystallise the most crucial lessons from the article:

- Analysis is not a one-off task: The most successful businesses treat competitive intelligence as an ongoing, iterative process. The Influencer & Advocate Monitoring and Share-of-Voice examples, in particular, highlight the need for continuous tracking to spot trends and react swiftly.

- Qualitative data holds the key: While quantitative metrics like market share are vital, the why behind the numbers often lies in qualitative data. The Customer Pain Point & Feature Gap Analysis demonstrated how real customer quotes and complaints are invaluable for product development and marketing messaging.

- Your competitors’ customers are your best source of intel: Why guess what the market wants when you can listen directly? Every framework, from Perceptual Mapping to Win/Loss Analysis, becomes exponentially more powerful when informed by the candid, unfiltered feedback of your rivals' customer base.

- Actionability is the ultimate goal: A beautifully crafted analysis that sits in a folder is useless. Each competitor analysis example in this guide was structured to lead directly to actionable outcomes, whether that's refining a value proposition, identifying a new target audience, or prioritising a feature on your product roadmap.

Your Actionable Next Steps

Feeling inspired but unsure where to begin? Don't let the scope of possibilities lead to inaction. The path from analysis to action is built one step at a time. Here is a simple, effective plan to get started:

- Define Your Primary Goal: What is the single most important question you need to answer right now? Is it "Why are we losing deals to Competitor X?" (start with a Win/Loss Analysis) or "Where is there an unmet need in our market?" (begin with a Pain Point & Feature Gap Analysis). Choose one clear objective.

- Select Your Framework: Based on your goal, pick the single most relevant framework from this article. Trying to do everything at once is a recipe for failure. Focus your efforts on one method to begin with and master it.

- Identify Your Listening Posts: Where do your target customers and your competitors’ customers congregate online? Pinpoint the key subreddits, forums, social media groups, and review sites. This will be your primary source of raw intelligence.

- Implement a Listening Tool: Manually tracking these sources is inefficient and unsustainable. This is where a dedicated tool becomes essential. It automates the data collection, allowing you to focus your valuable time on the most important part: the strategic analysis.

By following this focused approach, you transform competitor analysis from a daunting academic exercise into a manageable and highly impactful business activity. The insights you need to outmanoeuvre your competition, delight your customers, and drive sustainable growth are already out there. They are being shared every minute of every day in plain sight. It's time to stop guessing and start listening.

Ready to uncover what your competitors' customers are saying and turn those conversations into a competitive advantage? With ForumScout, you can begin monitoring relevant online communities and get actionable insights in minutes, automating the most time-consuming part of any competitor analysis example we've covered. Start your free trial at ForumScout and discover the intelligence you've been missing.