- 22 min read

Types of Market Research in 2026

Diving into the world of market research can feel like preparing to climb a mountain. It often seems like a massive, expensive undertaking reserved for giant corporations with bottomless budgets. But what if it's less about the size of your budget and more about picking the right type of market research for the job at hand?

This guide is here to cut through the noise, breaking down the essential concepts into simple, actionable ideas.

Choosing the Right Tool for the Job

You wouldn't use a sledgehammer to hang a picture frame, right? The same logic applies here. The research method you choose has to fit the business question you’re trying to answer. The goal is always to get the most relevant information as efficiently as possible, without spending a fortune.

We’re going to walk through the essential types of market research to help you pick the perfect approach. It all starts with two fundamental choices that will shape your entire plan.

The Two Foundational Choices

Every single research project kicks off with two big decisions. Get these right, and you're already halfway to uncovering the insights you need.

- Primary vs. Secondary Research: Are you going to create brand-new data from scratch, or can you work with information that someone else has already gathered? This is the classic split between running your own customer surveys versus digging into published industry reports.

- Qualitative vs. Quantitative Research: Are you trying to understand the "why" behind what people do, capturing stories and feelings? Or are you focused on the "how many," relying on hard numbers and statistics? This determines whether you’ll be conducting in-depth interviews or launching a large-scale poll.

The core principle is simple: match your method to your mission. A startup testing a new product idea needs different tools than an established brand measuring customer satisfaction. Understanding the different kinds of market research is the first step toward making smarter, data-driven decisions.

Making Research Accessible

For small and medium-sized businesses, the very idea of market research can be a turn-off. We’ve all heard horror stories about the costs of traditional methods like focus groups or huge telephone surveys. They can be incredibly expensive and take ages to complete.

Luckily, that's not the world we live in anymore.

Modern, affordable tools have put powerful insights within everyone's reach. As you explore different ways to collect data, it’s worth looking into specialised tools like market research proxies that help gather broad, unbiased information from across the web.

Methods like social listening and online surveys let you tap directly into customer conversations and get feedback quickly and cheaply. It’s a whole new ball game, and it helps you compete without needing a massive budget.

Primary vs Secondary Research: Fresh Insights or Existing Knowledge?

The first big decision on your research journey is figuring out where your information will come from. This choice splits all research into two fundamental camps. Getting this right is the key to building a strategy that's both effective and budget-friendly.

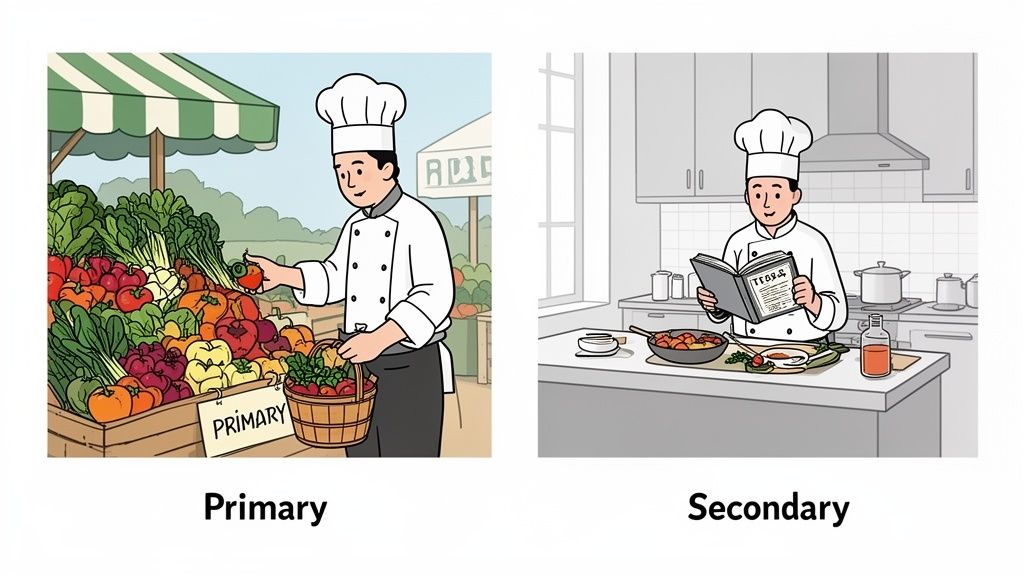

Think of yourself as a chef tasked with creating a signature dish. You could head to the market, hand-pick fresh, unique ingredients, and build something entirely new from scratch. This is primary research—you’re gathering original data directly to answer your specific questions.

Or, you could consult a trusted cookbook filled with recipes tested and proven by others. This is secondary research, where you use existing data that someone else has already gathered. This could be anything from industry reports to government statistics.

Unpacking Primary Research: The Fresh Ingredient Approach

Primary research is all about creating information that doesn't exist yet. You are the source. You design the study, you ask the questions, and you gather the responses straight from your target audience.

This is your go-to method when you need insights tailored precisely to your business. Maybe you want to know how customers feel about a new logo or what features they’d value most in a future product. No one else has this data because the questions are unique to you.

Common primary research methods include: * Surveys and Questionnaires: Directly asking a group of people for their opinions. * In-depth Interviews: One-on-one conversations to explore topics in rich detail. * Focus Groups: Moderated discussions with a small group to generate ideas and feedback. * Observational Research: Watching how people behave in a natural setting, like tracking user clicks on a website.

The main advantage here is specificity. The data is yours and it directly answers your question. The trade-off? This custom approach is almost always more time-consuming and can be more expensive to get right.

Exploring Secondary Research: The Cookbook Method

Secondary research involves analysing information that has already been collected, compiled, and published. You aren't creating new data; you're finding, synthesising, and interpreting what's already out there.

This is an excellent starting point for any research project. It’s perfect for understanding broad market trends, sizing up competitors, or just getting the lay of the land before you invest in more detailed primary studies.

Secondary research provides the context and foundation for your investigation. It helps you understand the bigger picture, identify knowledge gaps, and formulate smarter questions for your primary research.

Sources for secondary research are everywhere: * Industry Reports: Publications from market research firms like Gartner or Forrester. * Government Data: Statistics from sources like the Office for National Statistics. * Academic Journals: In-depth studies published by universities and researchers. * Competitor Materials: Publicly available information like annual reports, websites, and press releases.

This approach is typically much faster and more cost-effective. The UK's market research industry, with revenue hitting an estimated £6.4 billion, shows just how valuable this data is. This growth is driven by businesses using available data to get a handle on consumer behaviour and guide product development.

However, the UK Innovation Survey showed that only 36% of SMEs were 'innovation-active' from 2020-2022. This highlights why accessible, cost-effective secondary research is so vital for smaller companies to compete. You can learn more about the UK's market research industry dynamics and its impact on business innovation.

The downside is that the data wasn't collected for you, so it might not be a perfect fit. It could be slightly outdated or not quite granular enough for your unique business question.

To make the choice clearer, here’s a quick breakdown of how the two approaches stack up against each other.

Primary vs Secondary Research At a Glance

| Attribute | Primary Research | Secondary Research |

|---|---|---|

| Data Source | Collected firsthand (surveys, interviews) | Gathered from existing sources (reports, articles) |

| Specificity | Highly specific to your questions | General; may not directly answer your question |

| Cost | Generally higher (requires resources to collect) | Lower (often free or requires a subscription) |

| Time | More time-consuming (planning, execution, analysis) | Quicker to gather and analyse |

| Control | Full control over the methodology and questions | No control over how the data was collected |

| Best For | Answering unique business questions, testing concepts | Background research, market sizing, trend analysis |

Ultimately, the strongest research plans don't choose one over the other—they use both. Start with secondary research to build a solid foundation, then use primary research to fill in the specific gaps that only you can investigate.

Qualitative vs Quantitative Research: The Why vs The How Many

Once you’ve settled on using fresh or existing data, your next big decision is about the kind of information you need. This brings us to a fundamental fork in the road: qualitative versus quantitative research.

Put simply, it's the difference between asking "Why?" and asking "How many?"

Think of it like a doctor diagnosing a patient. Quantitative research is like taking their temperature, blood pressure, and heart rate. You get hard, measurable numbers that can be tracked and compared. It’s all about statistical, objective data points that help you test a specific hypothesis.

Qualitative research, on the other hand, is the doctor asking, "Can you describe the pain?" or "How have you been feeling lately?" This is where you get the rich, descriptive story behind the numbers—the motivations, opinions, and context that statistics just can't give you.

Understanding Quantitative Research: The 'How Many'

Quantitative research is all about structure and statistics. It’s designed to measure attitudes, behaviours, and other variables from a large group to spot patterns and generalise the findings. You’re looking for concrete data you can neatly package into charts and graphs.

This kind of research is conclusive. Its whole purpose is to give you a statistically sound answer to a very specific question.

Common quantitative methods include: * Surveys and Polls: Using multiple-choice or scaled questions to collect numerical data from a wide audience. A classic example is asking customers to rate their satisfaction on a scale of 1-10. * A/B Testing: Comparing two versions of something—like a webpage or an ad—to see which one performs better based on metrics like click-through rates. * Analytics Tracking: Monitoring website traffic, social media engagement, or sales figures to identify clear, data-backed trends.

This approach is your go-to for validating an idea. If you believe a new feature will boost user engagement by 15%, a quantitative study is how you prove (or disprove) it.

Exploring Qualitative Research: The 'Why'

Qualitative research dives deep into human behaviour. It's exploratory, aiming to get at the underlying reasons and motivations driving people's decisions. The data you collect here is non-numerical—it comes in the form of words, observations, or even images.

This is where you find the texture and depth that cold numbers often miss. It’s not about how many people clicked a button, but why they felt compelled to click it—or, just as importantly, why they ignored it completely. You’re uncovering the human story.

Qualitative research gives you the direct voice of the customer. It's the unfiltered feedback, the emotional reactions, and the nuanced opinions that explain what the numbers actually mean in the real world.

Key qualitative methods are: * In-depth Interviews: One-on-one conversations that let you ask detailed, open-ended questions and follow up on interesting threads. * Focus Groups: Moderated discussions with a small group of people to explore their shared perceptions and attitudes on a topic. * Social Listening: Monitoring conversations on forums, Reddit, and social media to capture unsolicited, authentic opinions about your brand or industry.

This is the perfect starting point for a project when you're generating ideas, trying to understand a fuzzy problem, or building a hypothesis you can test quantitatively later.

When to Use Each Approach

Let's be clear: it's not a competition. The best research strategies almost always blend both approaches. You might start with qualitative research to explore a new market and uncover key customer pain points. Then, you can use those insights to build a quantitative survey to measure just how widespread those issues are.

Here’s a simple way to decide: * Use Quantitative research when you need to validate or test a theory, measure trends, or make a final decision based on hard numbers. * Use Qualitative research when you need to explore ideas, understand motivations, or get a deep, nuanced understanding of a problem.

By getting comfortable with both "the why" and "the how many," you can pick the right research method to answer your biggest business questions with confidence.

Uncovering Hard Numbers with Quantitative Methods

While qualitative research tells you the rich stories behind customer behaviour, quantitative methods give you the hard evidence to back it up. This is where we get into the "how many" part of the equation. You're moving from exploring ideas to proving them with cold, hard numbers.

Think of it as switching from a friendly conversation to a nationwide census. You’re no longer asking "why," but instead focusing on measuring, counting, and spotting patterns.

This type of market research is all about collecting numerical data that can be crunched to validate hunches, spot trends, and make decisions with confidence. The aim is to get a sample size big enough to apply your findings to the wider market, turning individual opinions into measurable facts.

The Power of Surveys and Polls

Surveys are the undisputed champions of quantitative research. They’re a flexible and scalable way to gauge customer sentiment, test out product ideas, or figure out how big your market really is. Online surveys, in particular, have become the go-to for businesses of all shapes and sizes. They let you reach a huge audience quickly and without breaking the bank, gathering structured data through multiple-choice, rating, or scaled questions.

Online surveys are easily the most dominant quantitative method out there, with 85% of professionals worldwide using them regularly. This isn't just a global trend; it's strongly mirrored in the UK, where fast, efficient research is crucial for making smart decisions. With nearly 3 million active businesses in the UK, it's no surprise that affordable tools that help make sense of survey data are in high demand. You can get the full picture by checking out these market research statistics and trends.

When you're putting a survey together, the golden rule is to write unbiased questions that don't lead the person answering. For example, asking, "Don't you agree our new feature is amazing?" is a classic mistake. A much better question would be, "On a scale of 1 to 5, how useful do you find our new feature?" The first one is fishing for compliments; the second is gathering honest data.

A well-designed quantitative survey acts like a precise measuring instrument for your market. It eliminates guesswork and replaces it with statistical certainty, telling you not just what people might think, but what a representative sample actually thinks.

From Observation to Experimentation

Beyond just asking people questions, you can get incredible quantitative data by simply watching what they do. This is where observational and experimental research comes in, giving you powerful insights based on actual behaviour, not just what people say they’ll do.

Observational Research is all about tracking and measuring actions as they happen naturally. In the digital world, this is easier than ever.

- Website Analytics: Tools like Google Analytics are a goldmine. They show you exactly how many people visit your site, which pages they linger on, and where they drop off.

- Click-Through Rates (CTR): Measuring the percentage of people who click on your ads or email links is a dead-simple metric that tells you how compelling your message is.

- Social Media Metrics: Keeping an eye on likes, shares, and comment volume gives you a solid number to measure your content's reach and engagement. If you want to dive deeper into capturing these conversations, check out our guide on what is social listening.

Experimental Research, which you probably know as A/B testing, is where you change one single thing to see how it affects an outcome. It’s a beautifully simple, scientific way to fine-tune your marketing and products.

For instance, an e-commerce store might test two different colours for its "Buy Now" button—let's say green and orange. They'd show the green button to 50% of their visitors and the orange one to the other 50%. By measuring which version leads to more completed sales, they can make a data-driven decision that directly boosts their revenue. This method takes all the opinions and guesswork out of the room and just lets the numbers decide.

Exploring Customer Stories with Qualitative Methods

While numbers give you the "what," qualitative methods are all about uncovering the far more interesting "why." This is where you dig into the stories, feelings, and hidden motivations that drive your customers' decisions. You're shifting from statistical proof to human understanding.

Think of it like this: quantitative data is like a map showing you where people are going. Qualitative data is sitting down with them and asking about their journey—why they chose that particular route, what they loved, and what frustrated them along the way. It adds rich colour and context to those black-and-white data points.

These methods are designed to be exploratory, helping you get to the heart of complex issues. Let’s look at the most effective ways to capture these customer stories.

Getting Personal with In-depth Interviews

An in-depth interview is a simple one-on-one conversation—a direct line into your customer's mind. This isn't a rigid Q&A it's a guided discussion where you can ask open-ended questions and really probe deeper when someone says something interesting. It’s an incredibly powerful way to understand nuanced perspectives.

For instance, a software company might use interviews to figure out why some users aren't adopting a new feature. Instead of a simple "rate this feature" survey, they can hear a user describe their confusion or frustration in their own words, revealing specific usability problems a survey would almost certainly miss.

The Power of Group Dynamics in Focus Groups

Focus groups bring together a small, hand-picked group of people (usually 6-10) to discuss a topic with a skilled moderator guiding the conversation. The real magic here is the group dynamic. Participants build on each other's ideas, debate opinions, and reveal shared attitudes that might not surface in a one-on-one chat.

Imagine a snack food company testing new packaging. In a focus group, they can observe not just which design people like, but the passionate debates that pop up about colours, fonts, and imagery. This kind of interaction generates candid feedback and often sparks entirely new ideas.

Social Listening: The Modern Goldmine of Qualitative Data

While interviews and focus groups are classics, the most scalable qualitative method today is easily social listening. Think of it as people-watching in a bustling town square, but on a global scale. It involves monitoring online platforms like Reddit, forums, and X (formerly Twitter) to capture unsolicited, authentic opinions about your brand, competitors, and industry.

This is where you find the raw, unfiltered voice of the customer. People aren't talking to a researcher; they're talking to each other, sharing honest frustrations, unexpected praise, and genuine desires. You can learn more about how to effectively capture the voice of the customer with these strategies.

The UK research insights industry, now valued at nearly £9 billion, shows just how much demand there is for this kind of analysis. While 34% of researchers globally still favour webcam interviews, the broader trend is moving online, with 85% of European researchers now conducting qualitative studies digitally. Social listening tools excel here, using AI to analyse emotions and deliver actionable insights faster than most traditional methods.

Platforms like this turn unstructured online chatter into a structured, analysable feed of qualitative insights.

Social listening provides a continuous stream of real-world feedback. It’s like having thousands of mini-focus groups happening 24/7, giving you a real-time pulse on what your market truly thinks and feels.

Once you’ve gathered all this rich qualitative data, the next critical step is applying the right qualitative data analysis methods to find the patterns and insights hiding within. This is how you transform raw conversations into a strategic advantage, identifying themes and sentiments that can guide everything from product development to your next marketing campaign. By understanding the "why" at scale, you can make decisions that actually resonate with your audience.

Building Your Market Research Plan

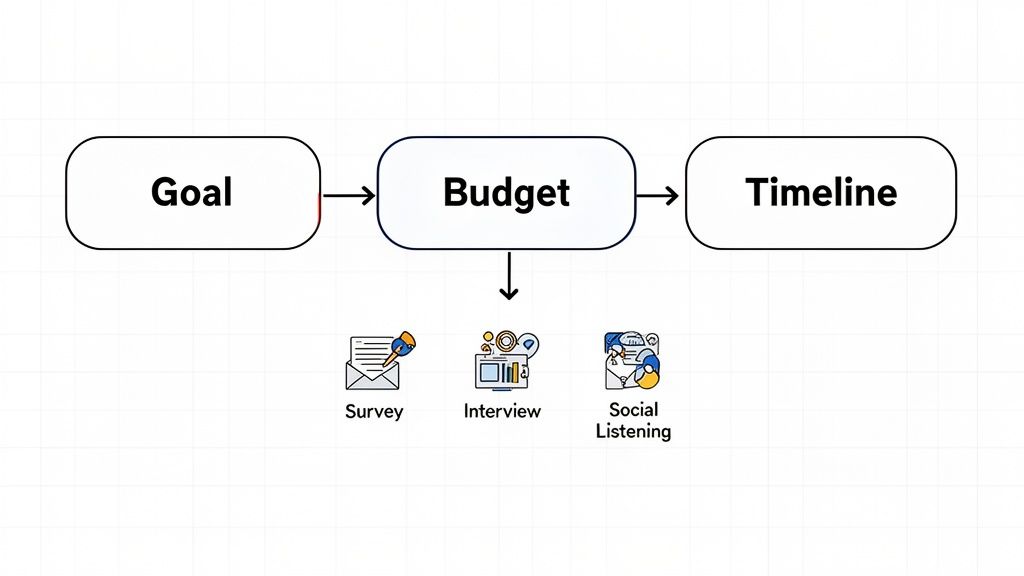

Knowing the different types of market research is one thing, but figuring out which one to actually use? That’s the real challenge. The good news is you don’t need to be a data scientist to make a smart choice. It really just boils down to asking three straightforward questions.

Your answers will give you a simple but powerful framework, pointing you straight to the methods that will deliver the most valuable insights for your business.

Start with Your Business Goal

First things first: what are you actually trying to achieve? Your goal is the single most important factor because it immediately tells you whether you need hard numbers to prove something (quantitative) or human stories to understand something (qualitative).

- Need to validate an idea? If you’re testing a price point, measuring brand awareness, or seeing if a new feature has legs, you need numbers. Quantitative methods like surveys or A/B testing will give you the statistical confidence you need to move forward.

- Need to explore a problem? If you’re trying to figure out why customers are leaving, what pain points your product isn’t solving, or how people really feel about your brand, you need context. Qualitative methods like in-depth interviews or social listening will uncover the “why” behind the data.

Nailing this down upfront stops you from gathering data that, while interesting, doesn’t actually help you make a decision.

Consider Your Timeline and Budget

Next, get real about your resources. The best type of market research is the one you can actually afford to finish on time. There’s no point planning extensive in-person focus groups if you’ve got a two-week deadline and a shoestring budget.

A quick online survey can deliver solid quantitative results in just a few days for minimal cost. On the other hand, a series of detailed interviews requires a much bigger investment in time for recruiting, conducting, and analysing the results.

Your budget and timeline aren't limitations; they're guide rails. They force you to be creative and efficient, often leading you to modern, cost-effective methods like social listening that provide deep insights without the traditional overhead.

The table below maps common business goals to the most suitable research methods, helping you see the clearest path forward.

Which Research Method Should You Choose?

This simple table connects common business challenges with the best research approach to solve them. Think of it as a quick-start guide to point you in the right direction.

| Business Goal | Recommended Research Type | Example Method |

|---|---|---|

| Test pricing for a new product | Quantitative | Online Survey |

| Understand customer churn reasons | Qualitative | Social Listening |

| Measure brand awareness | Quantitative | PR or Content Survey |

| Validate a new product idea | Mixed (Qualitative then Quantitative) | Interviews, then a Survey |

| Explore customer pain points | Qualitative | In-depth Interviews |

| Compare ad campaign effectiveness | Quantitative | A/B Testing |

By starting with your goal and then layering in your practical constraints, you can confidently select the right type of market research. This structured approach makes sure your efforts are focused, your resources are well-spent, and the insights you gather lead directly to smarter business decisions.

Common Questions About Market Research

When you first dip your toes into market research, a few questions always seem to pop up. Let's clear them up. Getting these basics right from the start makes everything else fall into place and shows how much easier the whole process is with modern tools.

Can I Mix Qualitative and Quantitative Research?

Absolutely. In fact, you should. Sticking to just one is like trying to understand a movie with either the sound off or the screen blacked out. You get part of the story, but you miss the full picture.

Combining the two—known as a ‘mixed methods’ approach—is where the real magic happens. It pairs rich, human stories with hard, undeniable numbers.

For example, you could start with qualitative social listening to see what complaints customers are airing out online. Once you spot a recurring theme, you can launch a quantitative survey to find out just how many of your other customers feel the same way. That’s how you get both the "why" it’s happening and the "how big" of a deal it really is.

How Much Does Market Research Cost?

This one’s a classic "how long is a piece of string?" question. The cost can swing wildly depending on the path you take.

When most people think of market research, they picture expensive, large-scale projects with focus groups and in-depth interviews that run into thousands of pounds. And sure, that's one end of the spectrum.

But you can get incredible insights without breaking the bank. Digging into public data through secondary research is often completely free. And today, powerful online survey platforms and social listening tools are available for a simple monthly subscription, putting top-tier research well within reach for teams on a tighter budget.

Which Type of Research Is Best for a New Product Launch?

For a new product, you’ll want a blend of research methods, tackled in phases.

Start with qualitative work to get the lay of the land. Dive into online discussions or run a handful of customer interviews to really understand people’s unmet needs and pain points. You're looking for the emotional context, the "aha!" moments that data alone can't give you.

Once you have that foundation, pivot to quantitative research. A well-designed survey is perfect for this. You can use it to validate your product idea, test which features get people excited, and get a solid read on market demand from a much bigger audience. This phased approach stops you from pouring money into development before you know for sure that you're building something people actually want.

Ready to turn online conversations into actionable insights? ForumScout helps you monitor brand mentions across the web, analyse sentiment, and find new customers before your competitors do. Start your free 7-day trial today.