- 22 min read

What Is Share of Voice and How to Increase Yours

Share of voice, or SOV, tells you how much of the conversation in your market belongs to your brand. It’s a straightforward way to measure your brand's visibility against your competitors, giving you a solid indicator of your presence and authority.

Understanding Share of Voice in Modern Marketing

Imagine your entire industry is one massive, noisy conference hall. Every brand, including yours, has a microphone and is trying to get the audience’s attention. Share of voice is simply the measure of whose microphone is loudest and who’s being heard the most. It puts a number on your brand’s presence, benchmarking it directly against everyone else in the room.

Traditionally, this metric was all about paid advertising—comparing your ad spend to the total spend in your category. That still has its place, but the idea has grown. A lot. Today, share of voice covers a much wider range of places where customers interact with brands, including:

- Social Media Mentions: How often your brand gets tagged, mentioned, or debated on platforms like X (formerly Twitter), Reddit, and LinkedIn.

- Organic Search Visibility: Where you rank and how many impressions you get for the keywords that matter on search engines like Google.

- Earned Media Coverage: Mentions you get in news articles, blog posts, and other online publications without paying for them.

- Forum and Community Discussions: Real conversations happening in niche communities where your ideal customers hang out.

This shift is a big deal because people today are influenced by much more than just ads. What their peers say, what they find in community threads, and what pops up in a search result—these all play a huge role in shaping what they think and what they buy.

Share of Voice at a Glance

To make sure we're on the same page, here’s a quick summary of what Share of Voice is and is not. It's a simple way to grasp the core concept at a glance.

| What It Is | What It Is Not |

|---|---|

| A comparative metric that benchmarks your visibility against competitors. | Just a measure of your own brand's mention volume in isolation. |

| An indicator of market presence and brand awareness. | A direct measure of sales, revenue, or customer satisfaction. |

| A strategic tool for spotting competitive threats and opportunities. | A simple vanity metric that looks good but offers no real insight. |

| A measure of earned and owned media, not just paid advertising. | Limited to ad spend, like it was in the past. |

Thinking of SOV this way helps you move beyond just counting mentions and start using it as a true strategic tool for growth.

Why SOV Is More Than a Vanity Metric

It's easy to write SOV off as just another number to stick in a report, but it’s actually a powerful predictor of future growth. Time and again, we see that a consistently higher share of voice directly correlates with an increase in market share. When your brand dominates the conversation, it builds the kind of familiarity and trust that makes you the go-to choice when someone is ready to buy.

Share of voice provides a crucial measure of your visibility and prominence. It's not just about being part of the conversation; it’s about understanding your brand's influence and competitive standing in real-time.

By tracking SOV, you stop looking only at your own internal numbers and start getting a clear, actionable view of the entire competitive field. For a deeper dive, the guide on What Is Share of Voice and How Do You Win It offers some great foundational insights. It helps you answer the big questions: "Are our marketing campaigns actually cutting through the noise?" and "Which competitor is starting to pull ahead?" This is the kind of strategic intelligence you can’t afford to ignore if you’re serious about growth.

Three Key Methods for Calculating Share of Voice

Figuring out your brand’s share of voice isn’t a one-size-fits-all job. The right way to measure it really depends on your goals, your industry, and the channels that matter most to you. We can break it down into three core approaches, starting with the old-school advertising metrics and moving into the more complex world of digital conversations.

Get to grips with these methods, and you’ll be able to pick the one that fits your business and start getting a true sense of your market presence. Each one tells a slightly different story, so let’s dive in.

Method 1: The Classic Ad Spend Approach

Back in the day, the answer to "what is share of voice" was all about advertising budgets. This classic method is dead simple and still has its place, especially in industries that lean heavily on paid media. It’s all about measuring your ad presence against everyone else’s.

The formula is as straightforward as it gets:

SOV = (Your Brand's Ad Spend / Total Market Ad Spend) x 100

Let’s say your company spends £50,000 on ads in a single quarter. If the total ad spend for your entire industry over that same period was £500,000, your share of voice is 10%. Simple. It tells you exactly how much of the paid "airtime" you own.

While it’s great for benchmarking how effective your paid media is, it gives you a pretty limited view of today's customer journey, where organic chats and word-of-mouth often carry way more weight.

Method 2: The Modern Mentions Model

These days, conversations are happening all over the internet, well beyond the reach of paid ads. The modern way to calculate share of voice is to track brand mentions across social media, forums, and news sites. This is where most brands should be focusing their energy now.

The formula switches from money to volume:

SOV = (Your Brand's Mentions / Total Market Mentions) x 100

Imagine you’re keeping an eye on the UK beauty scene. If your brand was mentioned 2,000 times last month, and the total mentions for you and your top five competitors hit 20,000, your SOV would be 10%. This approach gives you a direct pulse on what people are actually talking about and how relevant your brand is.

For example, in a recent quarter, boots.com absolutely dominated the UK beauty websites market with a 7.28% share of voice. They left competitors like superdrug.com (3.0%) and amazon.co.uk (2.64%) in the dust. It just goes to show how tracking mentions reveals who's really leading the online conversation. You can dig into these UK beauty market insights on Statista.

Method 3: The Weighted SOV Calculation

The most sophisticated method acknowledges a simple truth: not all mentions are created equal. A feature in a major newspaper is obviously worth more than a single post on X with zero engagement. A weighted SOV adds a layer of quality on top of the raw quantity of mentions.

This approach assigns different values to mentions based on criteria you set, such as: * Reach or Impressions: How many people might have seen the mention? * Engagement: The number of likes, shares, and comments it got. * Sentiment: Was the mention positive, negative, or just neutral? * Source Authority: A mention from a top-tier industry blog carries more weight than one from a random account.

There’s no single, universal formula for weighted SOV because the "weights" you assign are completely down to what your business cares about. But what you get is a much more accurate picture of your brand's real influence.

It helps you understand not just how much people are talking, but the actual impact of those conversations. To get an even clearer picture of your competitive standing, have a look at our guide on how to conduct a competitor analysis.

How Share of Voice Evolved in a Digital World

The way we measure share of voice has been turned on its head. The old rules, once written in stone and based purely on who had the biggest ad budget, just don't cut it anymore. If you're still thinking of SOV as just your slice of the advertising pie, you’re working with a dangerously incomplete picture of your brand's real influence.

This isn't just a minor tweak; it's a fundamental shift driven by how people actually discover and talk about brands today. The conversations that truly shape opinions and drive purchases now happen far away from traditional ad placements. They're unfolding in real-time on Reddit threads, in niche forums, and across platforms like X and LinkedIn. This is where genuine sentiment is born.

Ignoring these organic discussions means you’re missing most of the story. You could be crushing it on paid media but completely losing the war in community forums where trust is actually built. This is exactly why modern social listening isn't just a nice-to-have; it's essential for getting an accurate read on where your brand truly stands.

The Great Shift in Media Spend

This evolution isn't just a theory; you can see it plain as day in the marketing budgets. The UK's 'great shift in media spend' is a perfect example of how traditional SOV metrics are failing to keep up. With CTV ad spend on track to blow past £0.9 billion and 74% of UK adults now streaming content, the advertising world itself has shattered into a million pieces. Brands have no choice but to look beyond paid channels to understand their visibility. You can get the full story by exploring the full analysis of media spend shifts on The Media Leader.

This new reality demands a new approach. To truly understand what is share of voice in this era, you have to track your presence across this entire fragmented landscape.

Adapting Your Strategy for a New Era

So, how do you adapt? First, you need to redefine your competitive arena. It's no longer just about the legacy players with the deepest pockets for ads. Your real competitors are any brand, big or small, that's capturing your audience's attention where they spend their time.

Here's how to start thinking differently about your strategy:

- Expand Your Channels: Stop tracking just paid ads. Your SOV calculation needs to include social media, forums, blogs, and news sites. No exceptions.

- Focus on Conversations: The game has moved from counting impressions to analysing what people are actually saying. Context is everything.

- Embrace Qualitative Data: Sentiment and emotion are now mission-critical. A huge volume of negative mentions isn't a win; it's a five-alarm fire.

A modern share of voice strategy isn't just about being seen; it's about being part of the right conversations, in the right places, with the right sentiment. It's the difference between shouting into a void and building genuine connections.

This wider, more honest view lets you make decisions based on what's really happening in your market, not on outdated metrics from a bygone era. It's about seeing the whole board, understanding every move, and positioning your brand to win where it actually matters to your customers.

How to Track and Improve Your Share of Voice

Knowing the theory behind share of voice is one thing, but putting it into practice is where you see the real results. Turning raw conversation data into a strategic advantage requires a clear process and the right tools. This is exactly where modern social listening platforms come in.

Instead of trying to manually piece together data from dozens of different sources, you can set up a project in minutes. These tools monitor your brand and your top competitors across thousands of online communities automatically. It’s the modern solution to SOV tracking, giving you a real-time view of your market's conversational landscape.

Setting Up Your SOV Tracking Project

Imagine you’re a new SaaS company trying to break into a crowded market. Your first move is to figure out who you're really up against. It’s not just the big, established players; you're also fighting for attention with a bunch of emerging startups.

A practical tracking setup would look something like this:

- Identify Your Keywords: Start by listing your brand name and the names of your top three to five competitors. These are the core keywords your project will track.

- Define Your Arena: Pick the channels where your audience actually spends their time. This could be specific subreddits, industry forums, LinkedIn, or X (formerly Twitter). A tool like ForumScout lets you monitor all these sources from one place.

- Launch and Monitor: Once your keywords and sources are locked in, launch the project. The platform will immediately start pulling in every relevant mention, giving you a constant stream of data.

This simple setup gives you a baseline for understanding what is share of voice for your brand right now. It takes the concept from an abstract idea to a tangible dashboard you can check every day.

From Raw Data to Actionable Insights

Just counting mentions is nowhere near enough. The real power comes from cutting through the noise and understanding the context behind the conversations. This is where features like AI-powered filters and sentiment analysis become so important.

For instance, our SaaS company might discover they have a high volume of mentions. But then, AI sentiment analysis reveals that 40% of them are from users frustrated with a recent product update. That’s a critical insight a simple mention count would completely miss. It’s not just about how much people are talking, but how they feel.

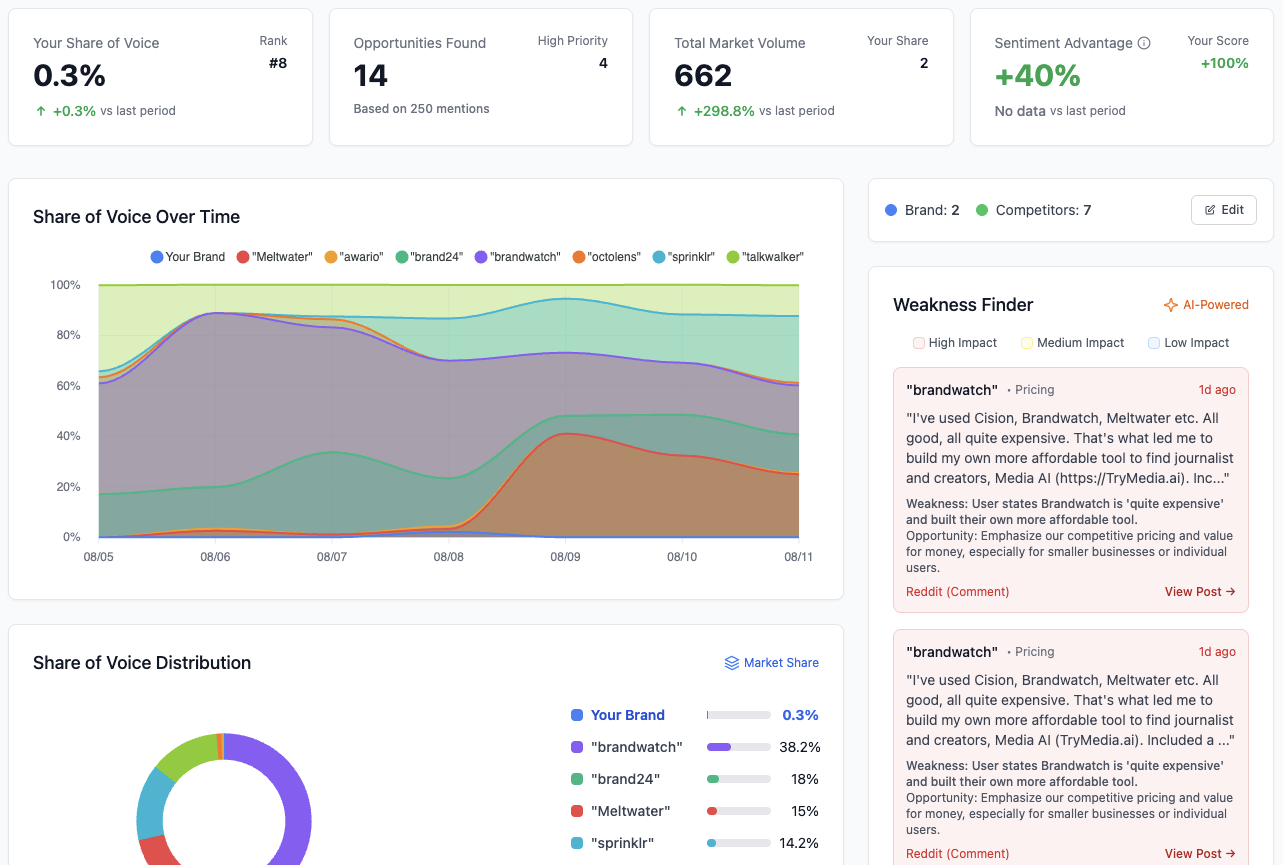

Below is an example of how a competitive intelligence dashboard visualises these insights, making it easy to compare sentiment and mention volume at a glance.

This kind of visual breakdown instantly shows where each competitor stands, highlighting opportunities and threats based on both the volume and the feeling behind the chatter.

Strategies to Actively Increase Your SOV

Once you have a clear picture of the competitive landscape, you can start making strategic moves to grab a bigger slice of the conversation. The insights from your tracking project should directly inform your actions.

Here are three actionable strategies you can implement right away:

- Engage in Unclaimed Conversations: Use your monitoring tool to find discussions about problems your product solves, but where none of your competitors are present. Joining these conversations and offering genuine help puts your brand directly in front of a highly relevant audience.

- Create Content That Fills Gaps: Did your analysis show a competitor is getting tons of positive mentions for their customer support? That's your cue. Create content—blog posts, case studies, or social threads—highlighting your own commitment to excellent service. For platforms like YouTube, using data-driven insights from YouTube analytics can directly shape your content strategy and help you measure your channel's share of voice.

- Target Competitor Weaknesses: If your sentiment analysis flags consistent complaints about a competitor's high price or a missing feature, you've struck gold. You can run targeted campaigns or create content that directly addresses that pain point, positioning your brand as the obviously better alternative.

The goal isn't just to talk more; it's to be more present in the right conversations. By turning listening into action, you can systematically and effectively grow your brand's presence and authority.

Improving your SOV is an ongoing cycle of listening, analysing, and engaging. With the right tools and a clear strategy, you can go from being a passive observer to an active participant in your market's most important discussions. For a deeper dive into how these tools work, you can learn more about what is social listening and how it powers modern marketing intelligence.

Common SOV Measurement Mistakes to Avoid

Getting your share of voice measurement wrong is often worse than not measuring it at all. When you're working with flawed data, you end up with flawed strategies, a wasted budget, and a pile of missed opportunities.

To get this right, you have to move beyond just counting mentions and start appreciating the nuances of digital conversations. Let's break down the most common traps that brands fall into and, more importantly, how you can sidestep them.

Focusing on a Single Channel

One of the easiest mistakes to make is putting all your focus on a single channel, like X (formerly Twitter) or Instagram. These platforms are obviously important, but they’re just one piece of a much larger puzzle. Your audience is spread out, having conversations in forums, on Reddit, in blog comments, and on news sites.

Imagine a B2B software company that only tracks its SOV on LinkedIn. They might think they're doing great, but they’re completely blind to the nitty-gritty, problem-solving discussions happening in specialised subreddits where their ideal customers are actually looking for solutions. This kind of tunnel vision creates a false sense of security while competitors are busy dominating conversations on other crucial platforms.

The Solution: Adopt an omnichannel approach. Use a comprehensive monitoring tool to track mentions across a wide range of sources, including social media, forums, and news outlets. This gives you a holistic and accurate view of what is share of voice for your brand across the entire digital ecosystem, not just a single, isolated channel.

Ignoring Context and Sentiment

Simply tallying up the number of times your brand gets mentioned is a recipe for disaster. A huge volume of mentions means nothing if half of them are from angry customers complaining about a product bug. Raw numbers lack the all-important context of how people actually feel about your brand.

For example, a fast-food chain could see a massive spike in mentions after launching a new burger. On paper, their SOV skyrockets. But what if a quick sentiment analysis revealed that 80% of that conversation was negative, with customers mocking the burger's taste? Without that context, the marketing team might mistakenly double down on a failing campaign.

A truly effective SOV analysis has to include:

- Sentiment Analysis: Are mentions positive, negative, or neutral? This gives you the general mood music around your brand.

- Emotion Analysis: Dig a little deeper. Are people expressing joy, anger, or anticipation? This adds another layer of understanding.

Defining Your Competitive Set Incorrectly

Your competitive set is almost certainly broader than you think. So many brands make the mistake of only tracking their direct, legacy competitors—the same old names they've been fighting against for years. In today's market, your biggest threat could easily be an emerging startup or even an indirect competitor solving the same customer problem in a totally different way.

A classic example is a hotel chain that only measures its SOV against other hotel chains. In doing so, they completely ignore the massive conversation happening around Airbnb and other holiday rental platforms. By failing to include these disruptive players in their analysis, they miss a fundamental shift in consumer behaviour and lose visibility among a whole new generation of travellers.

To avoid this trap, you need to regularly reassess who you're really competing against for attention and budget. A good analysis will show you all the other brands your audience mentions when talking about your industry, giving you a realistic and actionable list of competitors to track.

Connecting Share of Voice to Market Share Growth

Understanding your share of voice is more than just a brand health check; it’s a surprisingly accurate predictor of your future market share. This isn't just a marketing theory—it's a well-established principle explaining how visibility translates directly into business growth. The core idea is simple but incredibly powerful.

To grow, your brand’s share of voice needs to be consistently higher than its current share of the market. This difference is often called extra share of voice (ESOV), and it’s the engine that drives market share expansion over time.

Think of it like tending a garden. A steady, positive share of voice is the water and sunlight that nourishes your brand. The more nourishment it gets—through positive mentions, engaging conversations, and high visibility—the stronger its roots of brand recognition and trust become. This consistent care directly influences who customers choose when they're ready to buy.

The Proven Link Between SOV and Market Share

This isn't just a nice analogy; it's backed by decades of solid research. The foundational work from marketing effectiveness experts Les Binet and Peter Field provides clear, hard evidence of this relationship. After analysing hundreds of campaigns, they established a direct mathematical link between SOV and market share growth.

This principle is more relevant than ever as new channels pop up and grab audience attention. The explosive growth of Connected TV (CTV) in the UK, with ad spending forecasted to surpass £0.9 billion, perfectly illustrates these dynamics. Foundational research analysing 171 campaigns shows that achieving just 10% extra share of voice (ESOV) leads to an average market share increase of 0.5% per year. You can dig deeper into this with the 2025 advertising trends from IAB UK.

In essence, investing in your share of voice is a direct investment in your company’s future revenue. By dominating the conversation today, you are actively building the market share you will hold tomorrow.

Why Mastering SOV Is a Growth Imperative

When your brand consistently shows up in the right places at the right times, it becomes mentally available to consumers. This simply means that when a potential customer has a need your product can solve, your brand is the first one that springs to mind. This is the ultimate goal of building strong brand awareness, and SOV is the most effective way to measure your progress. Check out our detailed guide on how to measure brand awareness for some practical steps.

A proactive SOV strategy allows you to:

- Predict Future Growth: Use SOV trends as a leading indicator to forecast your market position in the coming months.

- Justify Marketing Spend: Demonstrate the clear link between your team's efforts to increase visibility and the company's bottom-line growth.

- Spot Competitive Threats: Notice when a competitor's SOV is on the rise and take action before they start eating into your market share.

Ultimately, mastering what share of voice means and how to grow it moves your marketing strategy from being reactive to predictive. You stop just responding to the market and start actively shaping it in your favour, securing a stronger, more profitable future for your brand.

Frequently Asked Questions About Share of Voice

Even when you've got the basics down, a few practical questions always pop up when it's time to actually put share of voice to work. This section tackles the most common ones head-on, giving you quick, clear answers to help you start using SOV like a pro.

What Is a Good Share of Voice?

There’s no magic number here. A ‘good’ share of voice is completely relative to where your brand sits in the market and what you’re trying to achieve. The best yardstick is always your share of voice compared to your actual share of the market.

For any brand trying to grow, the rule of thumb is simple: your share of voice should be higher than your share of market. Think of this gap as your growth engine. That "extra" voice is what helps you chip away at competitors and win over new customers.

On the flip side, an established market leader might just aim for an SOV that matches or barely nudges past their market share. For them, it's a defensive play—making sure their voice stays the loudest to maintain their top spot and stop smaller rivals from getting a foothold.

How Often Should I Measure Share of Voice?

How often you check in on SOV really depends on how fast your industry moves and what marketing campaigns you have running. For most companies, a monthly or quarterly check-in hits the sweet spot. It's frequent enough to spot meaningful trends and see if your campaigns are working, without getting lost in the noise of daily blips.

That said, all bets are off during critical moments. If you’re in the middle of a huge product launch, a massive ad campaign, or a key industry event, you need to be watching daily. Real-time tools let you see conversations as they happen, giving you the agility to tweak your strategy on the fly.

Can I Measure SOV with a Limited Budget?

Absolutely. You don’t need a massive budget to get started. While the big, paid tools give you the slickest, most accurate picture, you can definitely get a solid read on your SOV with a more hands-on approach.

You can start by manually tracking conversations using free tools:

- Google Alerts: Set up alerts for your brand name and your main competitors. You'll get an email every time a new mention pops up on the web.

- Social Media Search: Just use the native search bars on platforms like X (formerly Twitter) and Reddit. It's a surprisingly effective way to find out who's talking about you and your rivals.

The most important thing when you're doing it manually is consistency. You have to use the exact same keywords, timeframes, and methods every single time you measure. If you don't, your data won't be comparable, and your insights will be shaky at best.

Ready to stop chasing mentions manually and get a clear, automated view of your competitive landscape? ForumScout gives you real-time share of voice analysis, sentiment tracking, and competitive intelligence across forums, social media, and news. Start your free 7-day trial today.